Provisions and stores still impacted by volatility, but delivery capacity remains strong

Date: 05 September 2022

Market and business update - September 2022

Read report as PDF here

Read report as PDF here

Commodity markets are still characterized by inflation and volatility. The crude oil prices, freight rates and congestion rates have downturned over the recent months, but still remain on a considerably higher level than before Covid and the Russia-Ukraine war. Also, extreme drought in different parts of the world, adds to the pain, especially in the grain and electricity markets. These disruptions cause ripple effects on the commodities, but still our delivery capacity remains very strong.

This market and business update intends to give you an overview of expected price increases and decreases within the most important commodities, freight rates, supply chain challenges, and the additional effects of labor shortages, increased lead times and challenges in major ports.

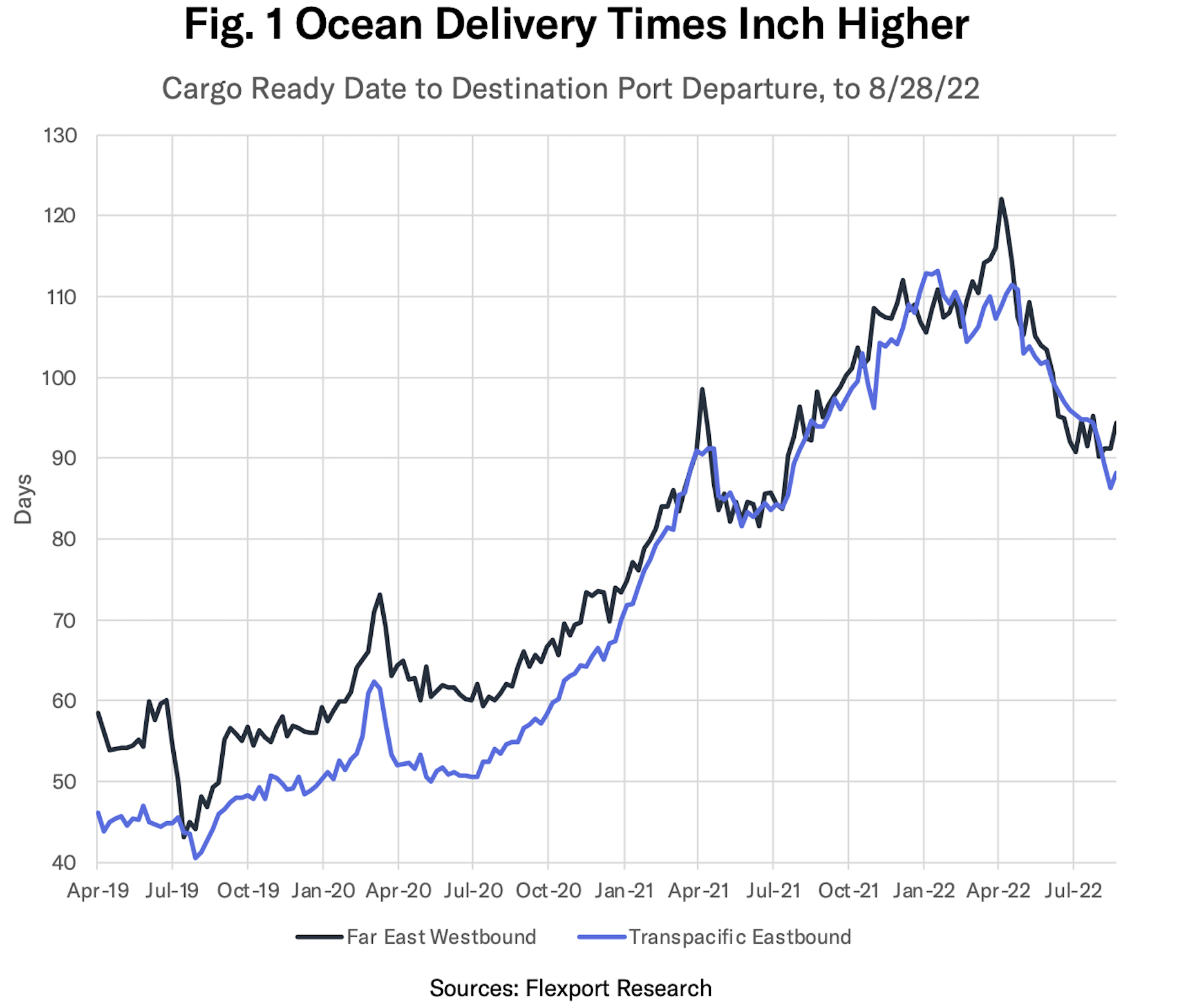

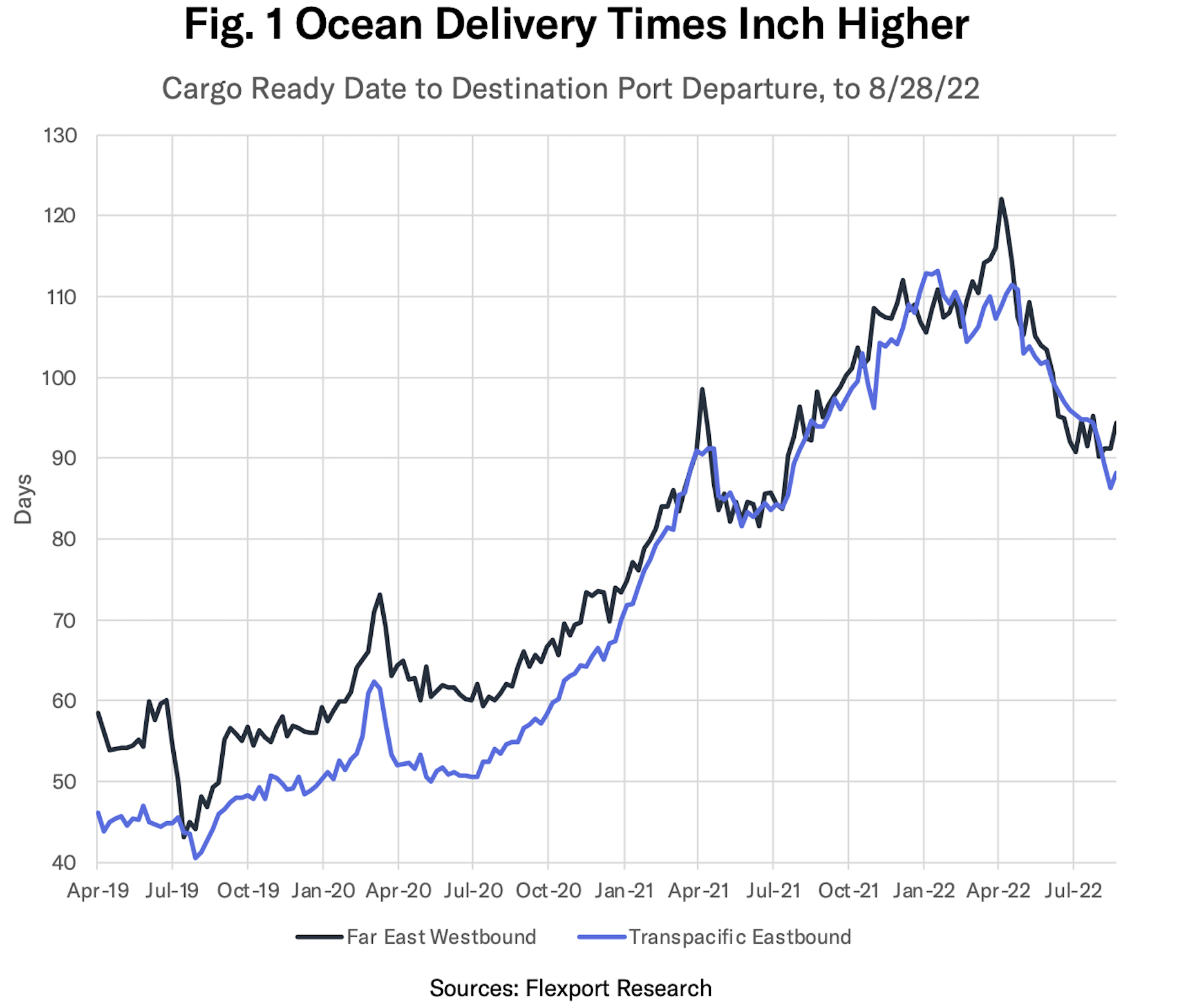

Congestion downturns before the peak season

Having suffered from considerable wait times, congestion, and delays that peaked in March and April this year, the Flexport Ocean Timeliness Indicator shows that the worst congestion of late 2021 and spring 2022 has passed. Transit times still remain above pre-pandemic levels, but the downturn is clear. TPEB fell to 88 days, and FEWB dropped to 94 days. However, as the September downturn comes right before the peak season, we might see new bottlenecks and increasing wait times in the coming months.

The Flexport Ocean Timeliness Indicator (OTI)

The Flexport Ocean Timeliness Indicator (OTI)

Transpacific Eastbound (TPEB)

- March 2021: 90 days

- March 2022: 108 days

- July 2022: 97 days

- Sept 2022: 88 days

Far East Westbound (FEWB)

- March 2021: 98 days

- March 2022: 110 days

- July 2022: 95 days

- Sept 2022: 94 days

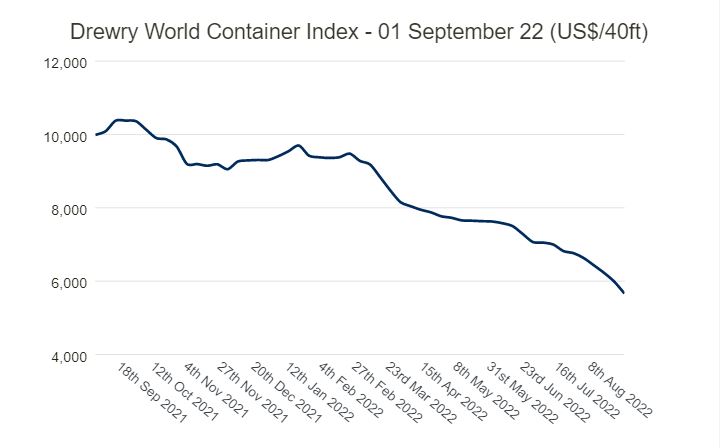

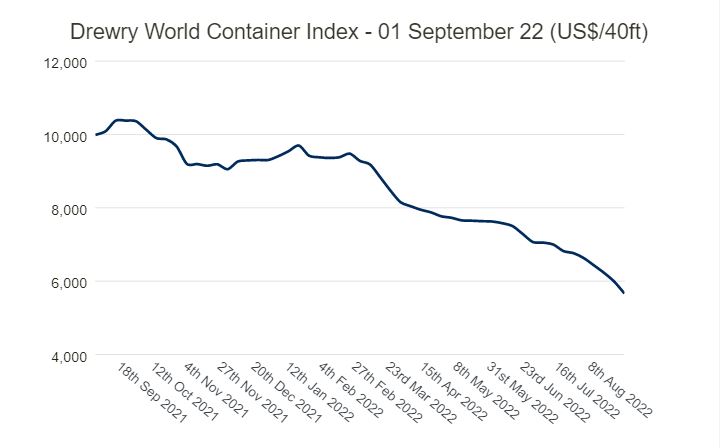

Freight rates still decreasing, but remain 55% higher than average

Freight rates still decreasing, but remain 55% higher than average

According to the Drewry World Container Index, freight rates have dropped by 43% when compared to the same week last year. However, a 40-feet container remains 55% higher than the 5-year average price.

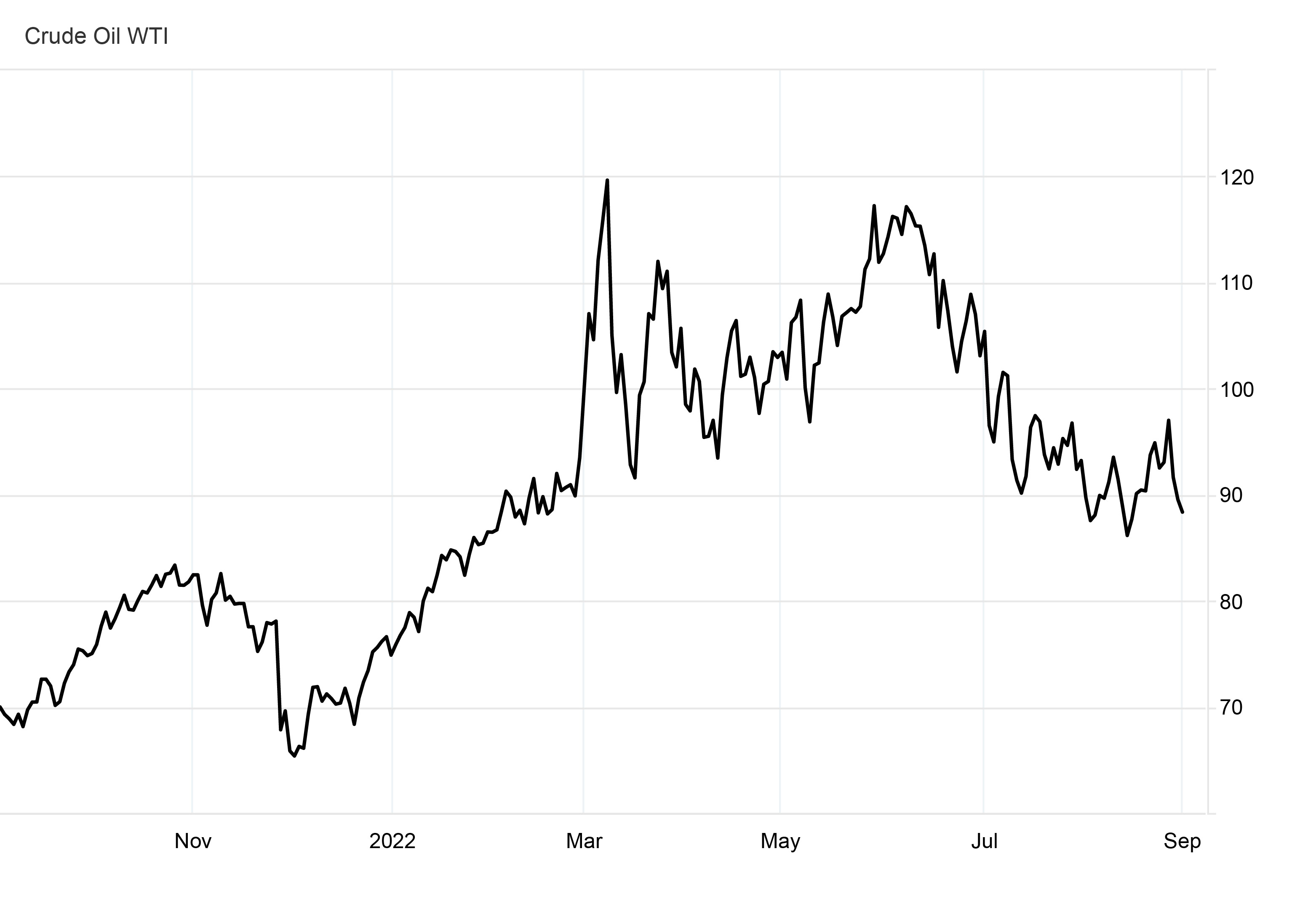

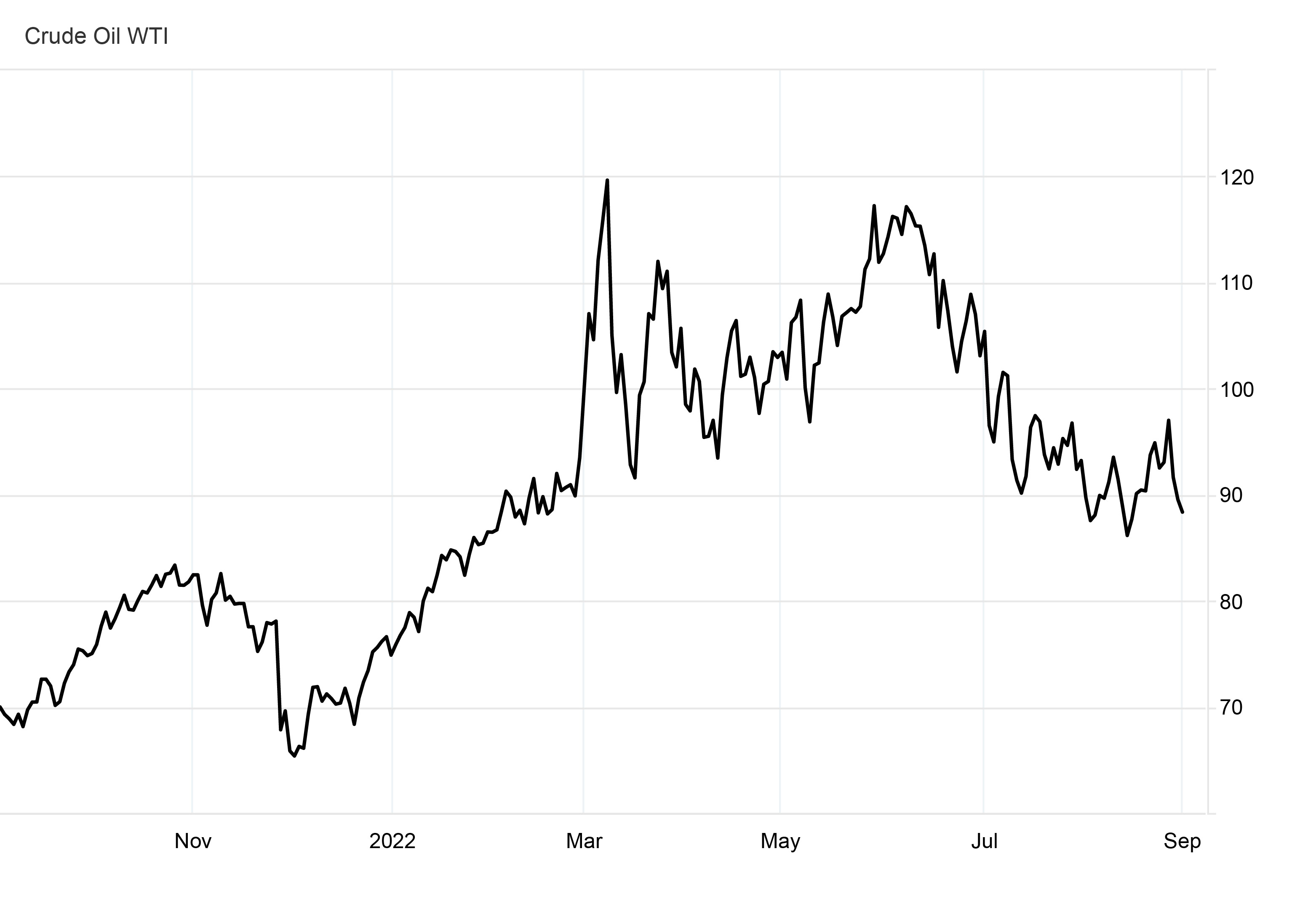

Downturn in crude oil prices, but still 45% higher than 1 Sep 2020

The high crude oil prices, driven by the discontinued Russian oil supplies, saw the third consecutive monthly decline. This incline is mainly driven by expectations of an economic slowdown, a minor decrease in demand for oil, and an expanded oil production in other countries. Still, the crude oil price is 45% higher than 1 September 2020.

Source: Trading Economics Index.

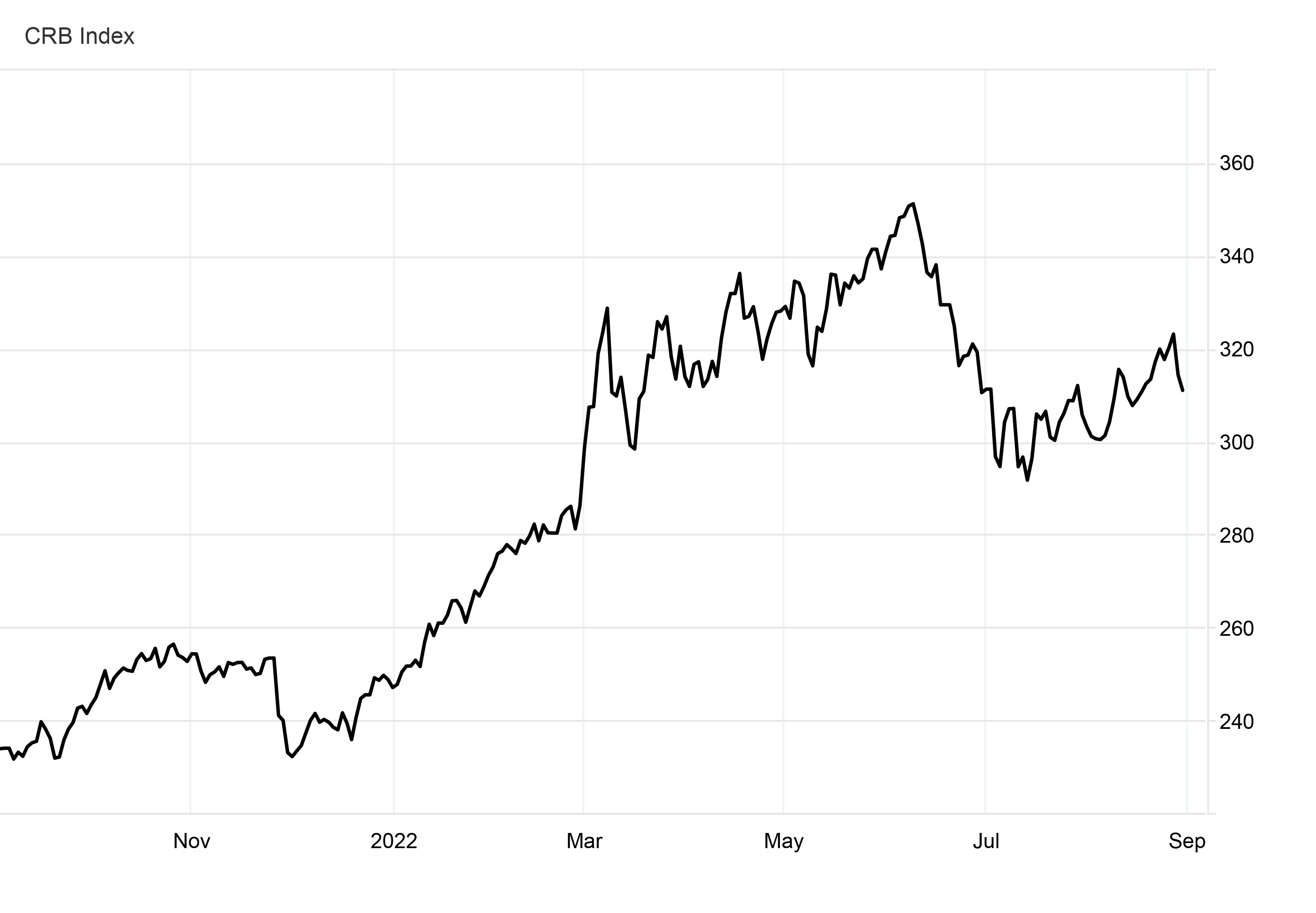

Inflationary impact on commodity prices

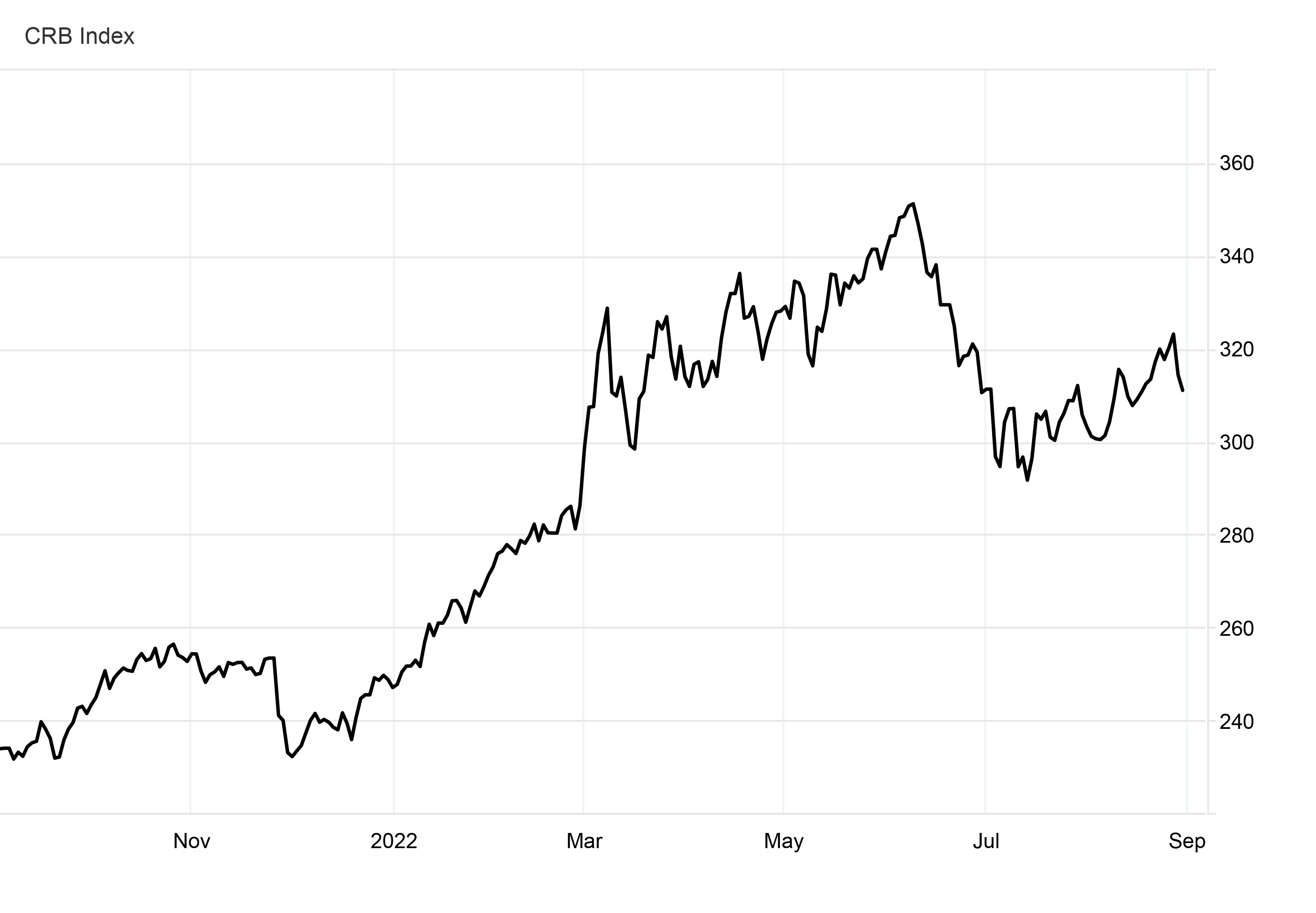

According to the CRB Index, the commodity prices increased by 64.04 points or 25.93% since the beginning of 2022, elevating also the price level of certain provisions and stores. However, other commodities have stabilized or decreased slightly due to the intermediate downturn of the commodity index from July to September this year.

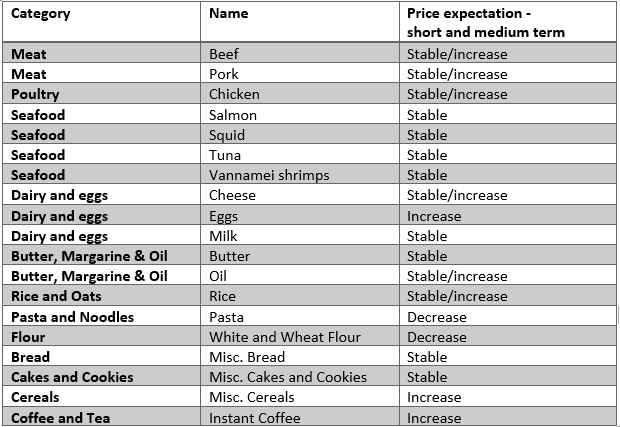

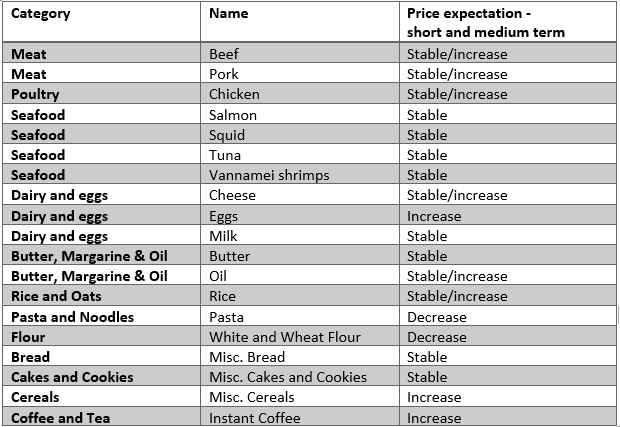

Inflationary impact on provisions

On short and medium term, we do not foresee any major shortages on provisions as our existing contracts are still honored by our suppliers, giving high priority to large customers. However, this situation might change any time due to volatility, forcing us to substitute certain products with comparable products.

According to the FAO Food Price Index, food prices averaged 140.9 points in July 2022, down 13.3 points or 8.6% from June 2022. Still, food prices are 16.4 points or 13.1% above its value compared to 2021.

Due to the inflationary effects, we expect certain price increases within the provision categories on short term. The list is not exhaustive.

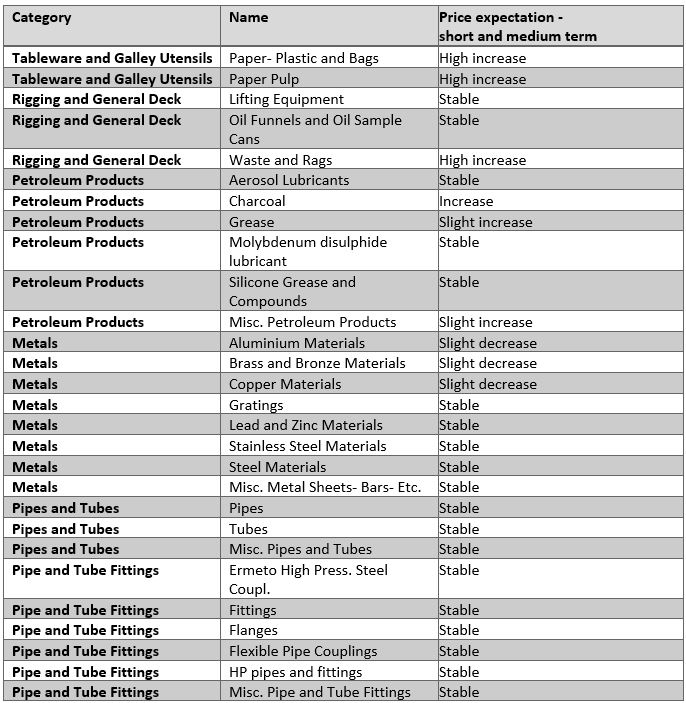

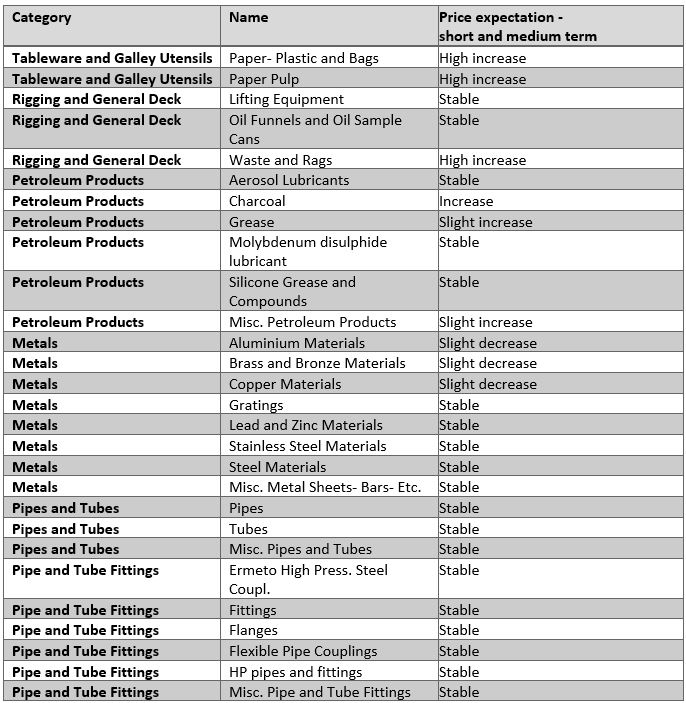

Inflationary impact on stores

On short and medium term, we do not foresee any shortages on technical consumables and stores. However, this situation might change any time due to volatility.

The raw material of several commodities is decreasing, but the increase in oil and gas prices in 2022 is feeding through into higher inflation, effecting raw materials, transport costs, energy costs and production costs. Due to the inflationary effects, we expect the prices of the following stores categories to increase on short term. The list is not exhaustive.

Inflationary and other macro impacts on major ports

| Seattle |

- Staff turnover and staff availability remain a big issue.

|

| Portland |

- No market changes registered

|

| Long Beach |

|

| New York/New Jersey |

- New York Terminal: At the start of week 34 there were 12 container vessels reported at anchorage awaiting a berth. From August 26, there were 12 vessels waiting. Waiting times for berths are running upwards of 32 days depending on terminal.

- Norfolk Terminal: There were 3 ships at anchor on August 26. Outside waiting time remains stable. Rarely more than 1-2 ships waiting.

|

| New Orleans |

- Barges keep facing capacity issues which are driving prices up because of the increasing labor and fuel costs.

|

| Jacksonville |

- Port congestion in the South East continues in certain ports (Savannah and Charleston the highest). More than 50 vessels currently sitting at anchorage outside of Savannah.

- Steel prices continue to sky-rocket, and we don’t see that changing in the near future.

|

| Houston |

- Domestic freight rates continue to see incremental increases after seeing favorable rates for the first half of the year, but they are still more favorable that what we experienced for the last two years. Airfreight continues to have delays due to lack of labor, equipment, and airlines overbooking cargo, bumping cargo as needed to maximize space and profitability for the airlines. The struggles in the workforce in this sector has also caused cargo centers to reduce their hours of operation, especially in the evenings and weekends. These operational difficulties and changes have definitely had an impact on spares and owners’ Goods.

- The Port Of Houston and container freight stations are backlogged, seeing anywhere from a three to four week delay on inbound containers. The Port of Houston is experiencing similar congestion that has been seen in Southern California. With that said, container rates continue to decline out of China. Steamship lines reserve the right to cancel voyages due to congestion in the East Coast and US Gulf ports. Due to this major congestion, we are now getting charged a congestion fee on each container pulled from the Port of Houston. Chassis shortages are still a major issue, adding up to another week of delays to the already delayed containers. We continue to see Customs/FDA holds and inspections on inbound cargo, and when this occurs it causes additional delays. All of these issues are exacerbating lead time, forcing us to bridge buy items at higher prices and/or short customers’ orders.

- All steel related items that have been on backorder from China have finally shipped, and several large manufacturers such as Kellogg’s, Coca Cola, and WD-40 are slowly recovering and are starting to ship some of the backordered products. While other manufacturers, such as Kikkoman, are still on allocation only due to labor shortages, COVID-19, and raw material shortages. Again, these issues are causing us to bridge buy items at higher prices from retailers and/or short customers’ orders.

- There continues to be a pallet shortage both locally and throughout the country.

- Looking forward, holiday season is almost upon us. We are already starting to see additional lead times and price increases with vendors explaining it is already due to the holidays. Also, fog season is approaching the Western US Gulf (October through March). When fog hits the region, it causes delays both inbound and outbound as well as vessel diversions. This can disrupt our inbound supply chain as well as our ability to deliver on time in full to our customers.

|

| Montreal |

- Similar to the rest of North America - labor shortages remains the biggest issue in Montreal and it keeps affecting the port and supply chain.

|

| Vancouver |

- There are storage issues, rail capacity issues and a trucker shortage all causing delays to the Port of Vancouver. All ports are seeing ships waiting longer than usual. It’s the same story we have been seeing the last few months.

- In the first half of 2022, container volumes at the Port of Vancouver dropped 7% from the same period a year earlier. But containers sat on the docks of the port for nearly 6 days on average, almost twice as long as in 2019 and a 41% increase from 2021. That time rose even higher in July, to more than six and a half days.

- The trucking sector saw record vacancies in the first quarter, with 25,560 unfilled driver positions between January and March.

|

| Rotterdam |

- The Netherlands and the Port of Rotterdam still have unprecedented labor shortages. Public transport services are reduced by 10% due to shortages, restaurants are open only a limited number of days per week. Still, there are long queues at the airports due to no security staff and no staff to handle the luggage.

- To mitigate the labor shortage in Rotterdam, we are looking into options of daycare possibilities offered by the company, and we offer bonuses to employees who bring in new colleagues, etc.

- We have increased our salaries per July 1st to mitigate risk of people leaving.

- There is a minor risk of a few late deliveries that we – of course – do our utmost to avoid.

|

| Algeciras |

|

| Singapore |

|

| Dubai |

|

| Shanghai |

|

| Dalian |

- The city of Dalian is under wide lockdown, but there is no major disruption for deliveries.

|

| Shenzhen |

- The city of Shenzhen is under wide lockdown, but there is no major disruption for deliveries.

|

| Aalborg |

- Price level for certain provisions is still getting higher and is very volatile.

- Shortage of commodities in specific categories now effects other commodities as demands move from one commodity to another.

- Especially non-food suppliers suffer from high freight rates and delays in supplies, putting pressure on reaction time from RFQ to Order.

|

The Flexport Ocean Timeliness Indicator (OTI)

The Flexport Ocean Timeliness Indicator (OTI) Freight rates still decreasing, but remain 55% higher than average

Freight rates still decreasing, but remain 55% higher than average