Date: 13 September 2023

Read the report as PDF here

Read the report as PDF here

Transit times and rates remained relatively stable in August and September, whereas crude oil prices have increased since June. The average price index for foods – provisions – slightly dropped. Yet, rice, sugar, and sunflower oil have been on the rise mainly influenced by adverse weather patterns in certain parts of the world.

This Market and Business Update intends to give you an indication of the expected price of the most important commodities, freight rates, supply chain obstacles, and challenges in major ports.

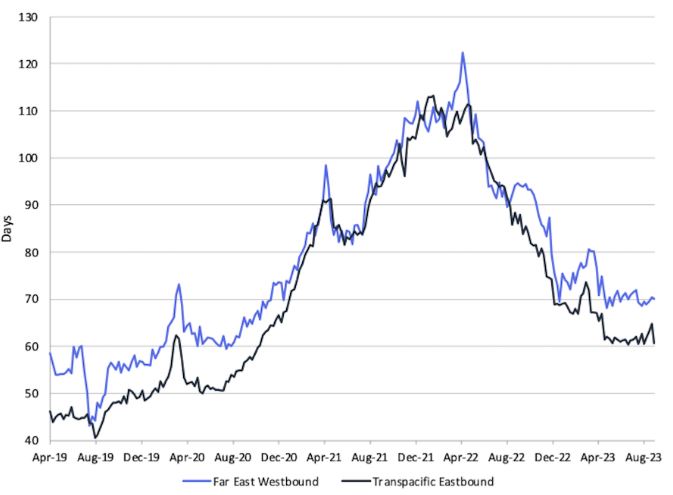

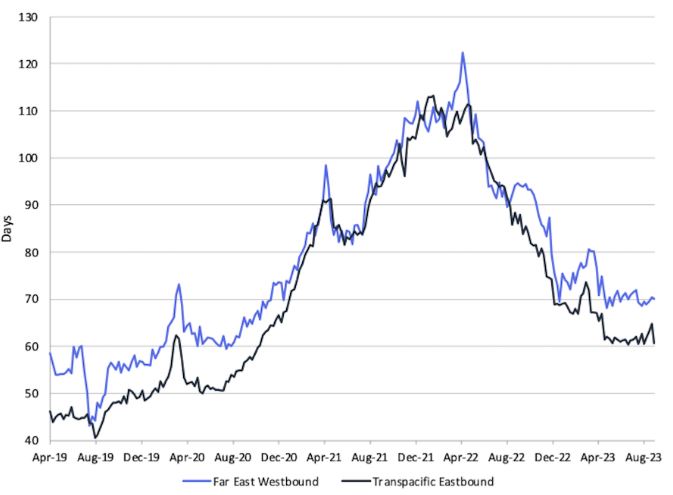

Transit times relatively stable since June 2023, but still remain above pre-pandemic level

According to the Flexport Ocean Timeliness Indicator, TPEB and FEWB transit times remain stable compared to June 2023, matching the average transit time in October 2020. The transit times have decreased significantly since 2021, however levels are still well above pre-pandemic level.

The Flexport Ocean Timeliness Indicator (OTI)

Transpacific Eastbound (TPEB)

- October 2021: 102 days

- October 2022: 82 days

- June 2023: 61 days

- September 2023: 61 days

Far East Westbound (FEWB)

- October 2021: 103 days

- October 2022: 89 days

- June 2023: 69 days

- September 2023: 70 days

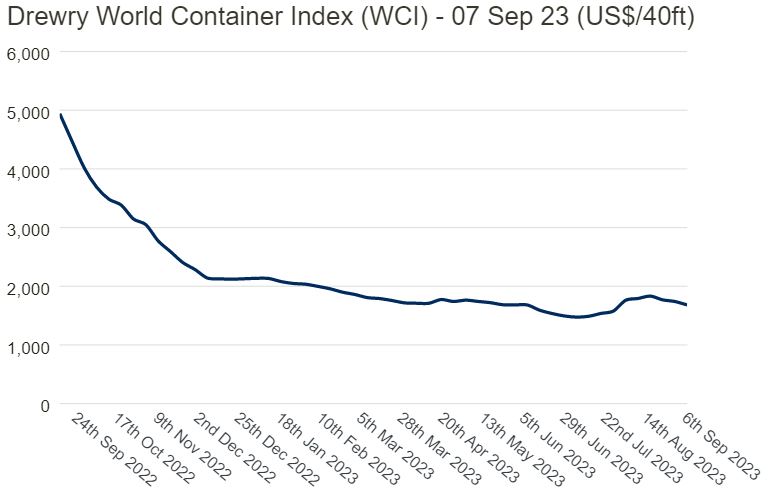

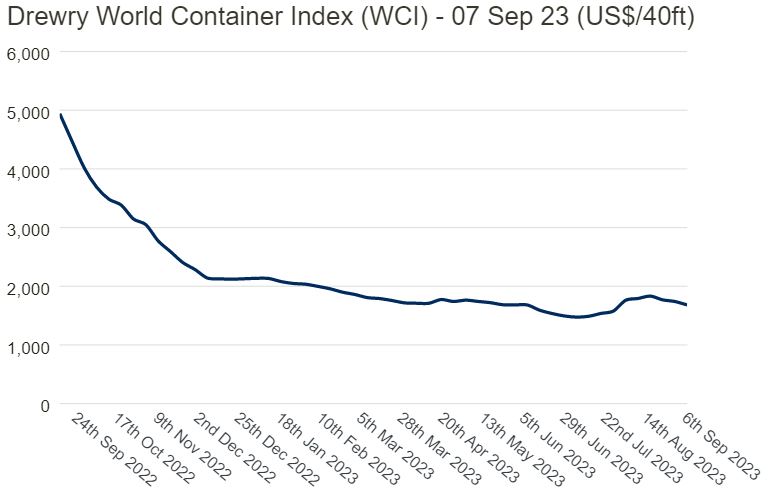

Freight rates remain stable, but expected to increase in Q4 2023

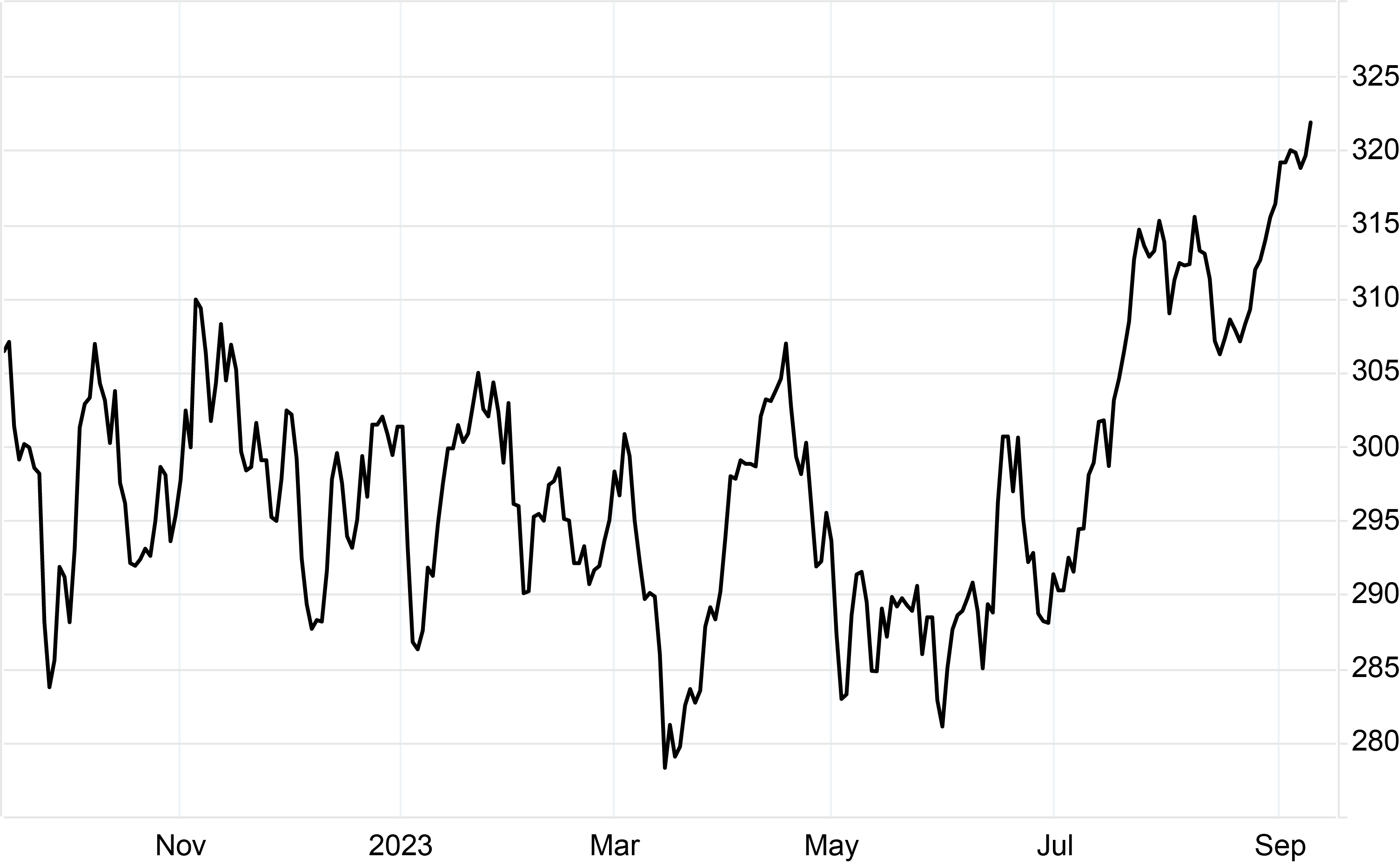

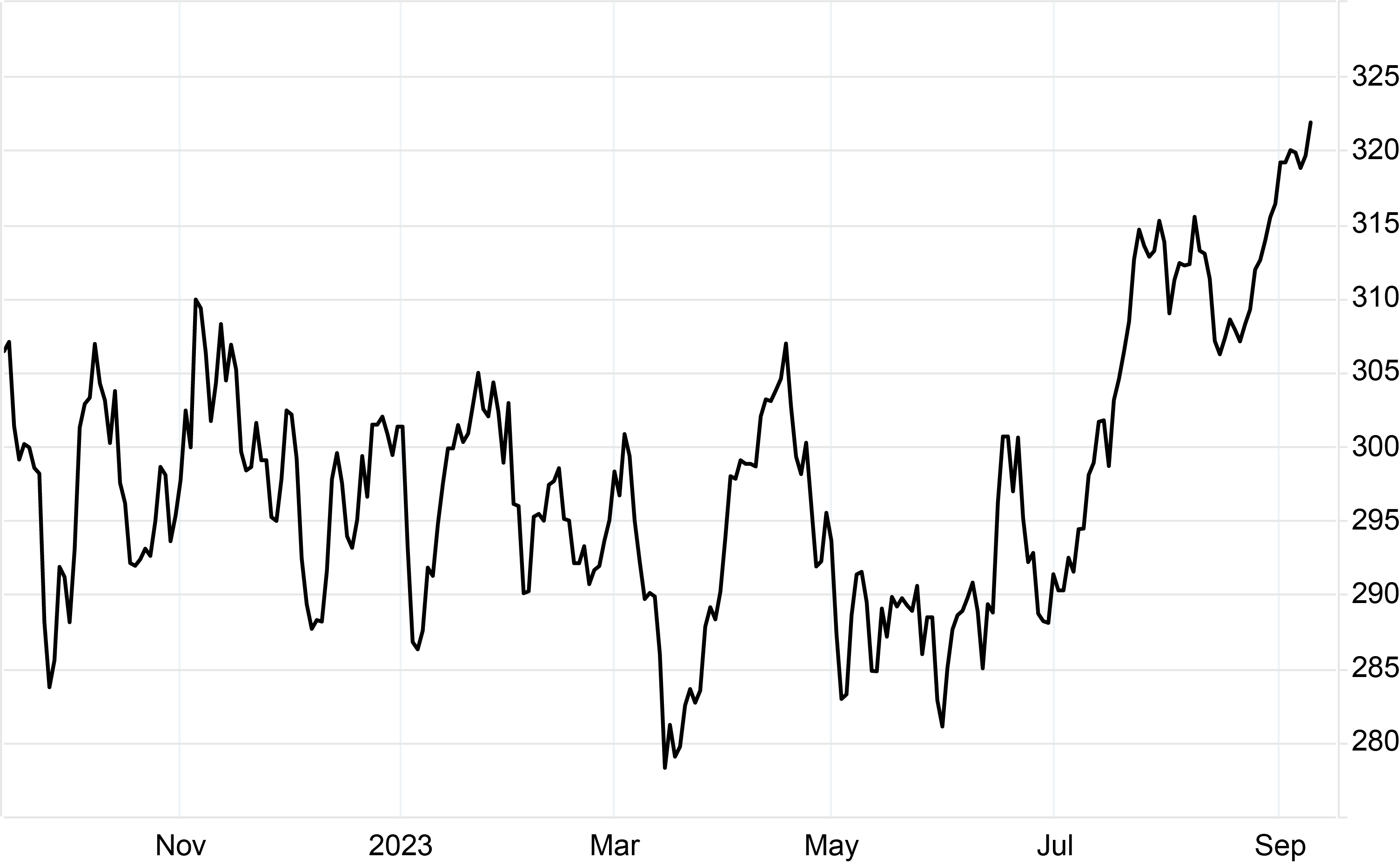

According to the Drewry World Container Index, a 40-feet container is now 84% below the peak reached in September 2021. However, the container index still remains 18% higher than average pre-pandemic rates in 2019. In Q4 2023, Freightwaves expects the 40-feet container index to increase due to a rise in ship fuel prices.

Oil prices have increased since June 2023 and are expected to continue rising throughout this year

Oil prices reached USD 87 a barrel this week, increasing from USD 70 in June 2023. By the end of this year, crude oil is expected to increase even further, and looking 12 months ahead, oil prices are estimated to trade at USD 98 (Source: tradingeconomics.com) after the OPEC+ countries have decided to extend their voluntary supply cuts of crude oil.

Commodity index on the rise

According to the CRB Index, the overall commodity prices increased from around 290 in June 2023 to index 320 second week of September 2023 mainly led by the increase in oil prices. Food prices averaged index 121 in August 2023 and dropped marginally compared to July 2023 (Source: FAO Food Price Index).

Other factors, including shortages in agricultural supplies related to the Russia-Ukraine war and adverse weather patterns, will maintain the high commodity price level in 2023.

Inflationary impact on provisions

According to the FAO Rice Price Index, rice increased by 10% compared to June 2023 and reached its highest level in 15 years, reflecting, among others, trade disruptions in India and irregular rain patterns in Thailand.

In July 2023, The FAO price index for oilseeds increased by 9% compared to June 2023, mainly driven by higher quotations of soybeans, rapeseed, and sunflower seed – and the recent drought in certain growing areas in the US. The rapeseed index increased, pushed by dry weather conditions across southern Canada and the northern parts of Europe, while a rise in the sunflower index was influenced by Russia’s intermediate termination of the Black Sea Grain Initiative. In August, The FAO Vegetable Oil Price Index decreased by 3%, reducing to some extent the increase recent month.

The FAO Dairy Price Index decreased by 4% from July to index 111 in August 2023, and the FAO Meat Price Index decreased by 3% from July to index 115 in August 2023 (Source: FAO Food Price Index ).

In the meantime, The FAO Sugar Price Index averaged index 148 in August, up 1.3% since July 2023, mainly influenced by concerns over the impact of the El Niño weather phenomenon, low rains in India, heavy rains in Brazil, and dry weather conditions in Thailand that affected the world’s sugarcane crop development (Source: The FAO Sugar Price Index).

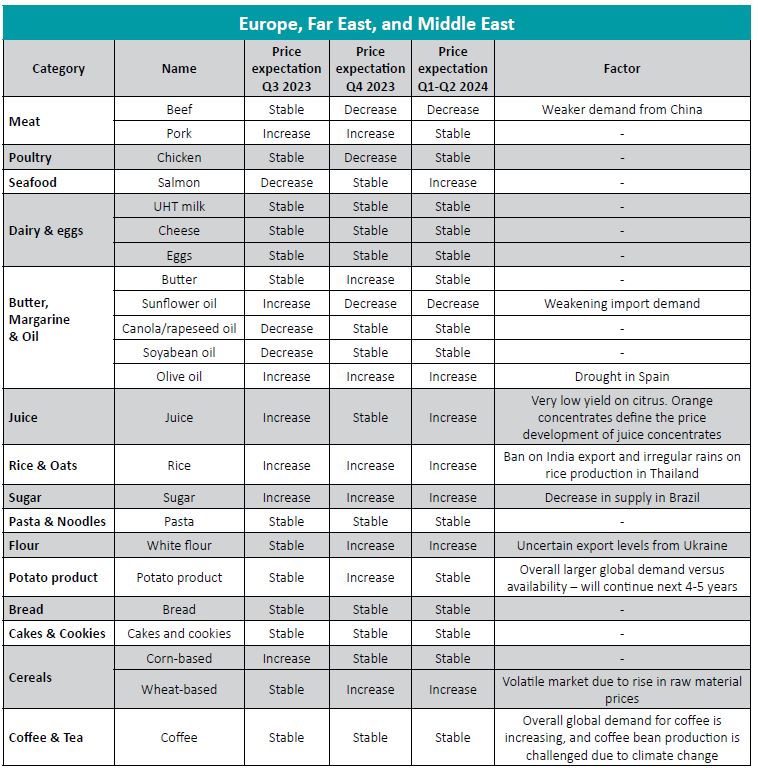

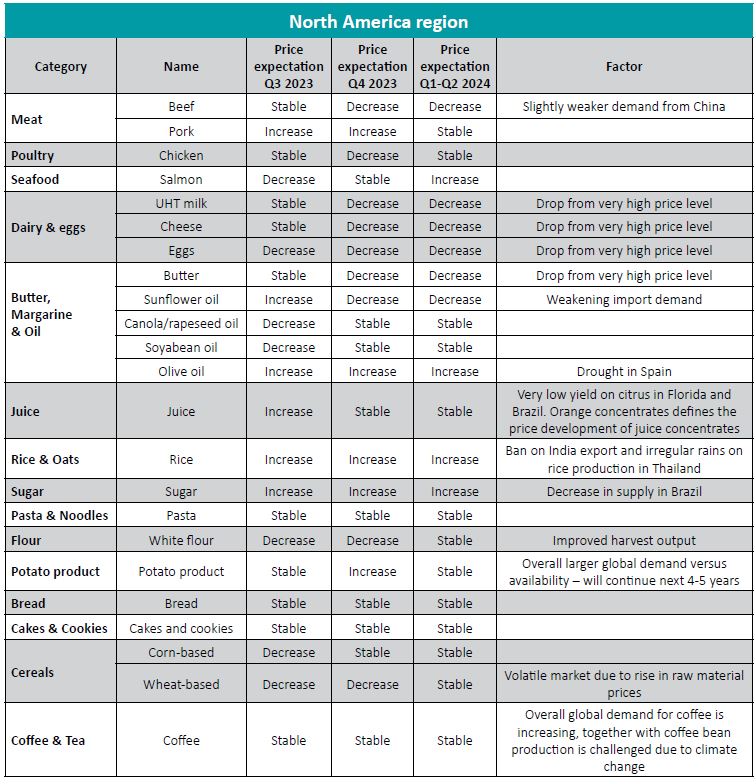

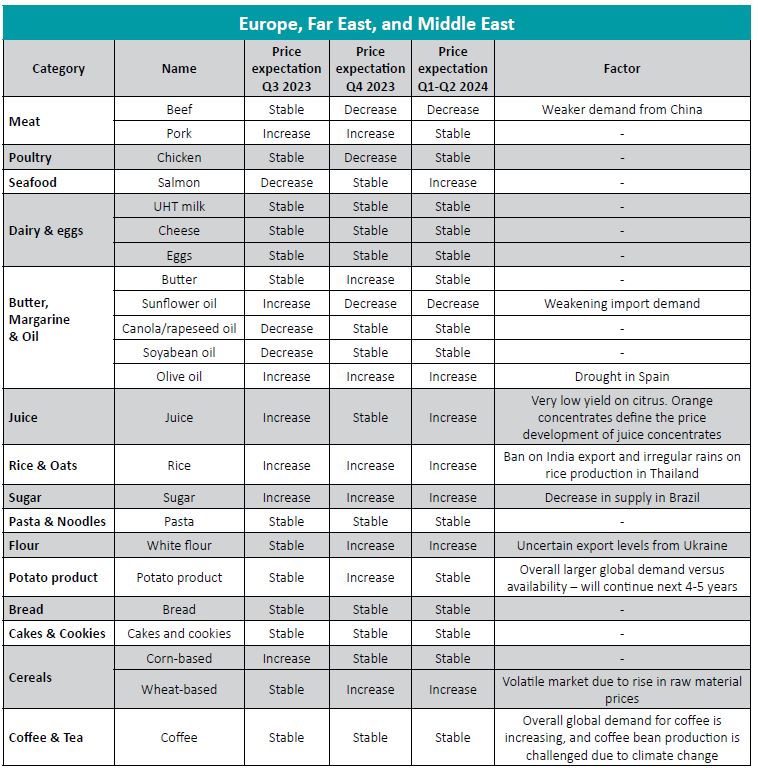

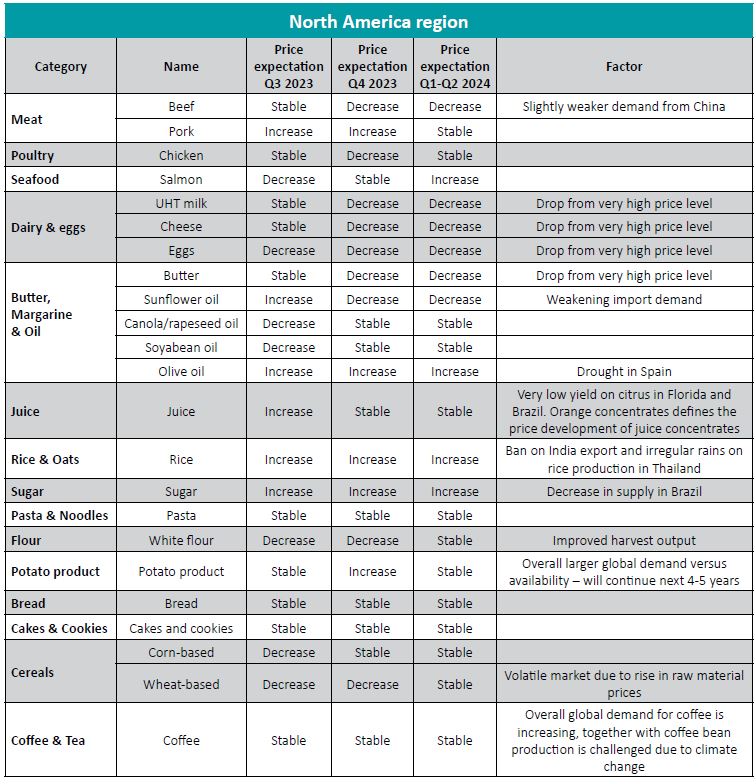

Price expectations for provision categories

In this Update, we describe price expectations within provision categories in Q3 and Q4 2023 including Q1-Q2 2024, in the following four regions: Europe, Middle East, Far East, and North America. The commodity markets are characterized by volatility, and the price expectations are subject to uncertainty and changes. s of provision categories are not exhaustive.

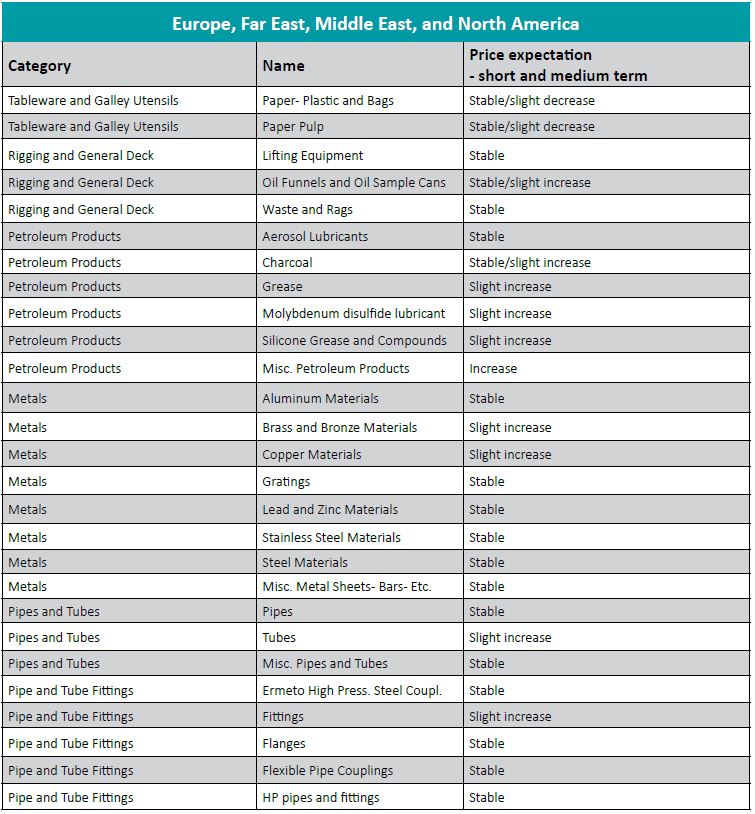

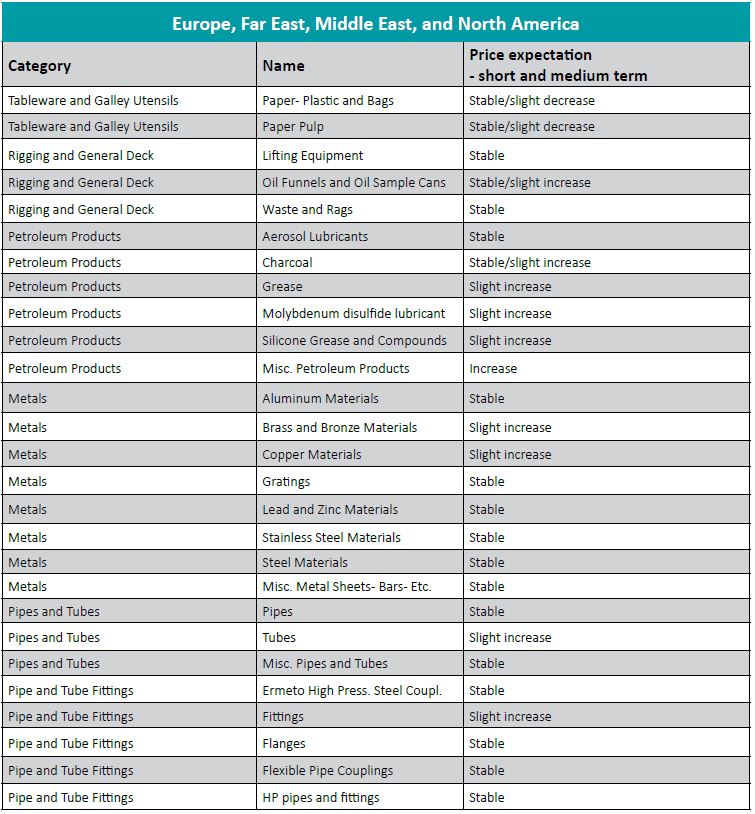

Price expectations for stores on short and medium term

The raw material of several commodities has been decreasing during recent months, for which reason we expect the prices of several stores categories to stabilize and/or slightly increase or decrease on short and medium term.

The list is not exhaustive.

Global port trends

Houston

- Holds from Customs, FDA and USDA on inbound cargo continue. Containers that are being selected for inspection are being held upwards for 6 weeks, and in some cases, items are being held for further review.

New Orleans

- Our Q4 is heavily going to depend on the start of the grain season. Report from the grain terminals is that it was a very good harvest, but they are having more difficulty finding buyers. This is due to the strength of the US dollar and cheaper grain available in South America.

Long Beach

New York/New Jersey

- US ports are expected to see an increase in import cargo volumes this summer, peaking in August 2023, despite an overall decrease compared to 2022.

- For East and Gulf Coast ports, volumes are expected to remain at higher levels than pre-pandemic primarily, as these ports have proven to be viable options for shippers. Meanwhile, the outlook for the U.S. economy remains unclear. In the meantime, U.S. consumers continue to spend, although more on service expenditures and less on retail goods.

Jacksonville

- Hurricane season has started and can potentially cause disruption and delays.

- The labor market continues to be the most challenging that we have seen. We continue to face driver shortages, and we have been forced to increase wages.

- We are experiencing an exponential increase in our Operating Cost due to the fuel, insurance, and maintenance fees going up.

- The cost for new assets continues to increase, and the availability remains bleak.

- Port congestion in the South East continues in certain ports (Savannah and Charleston the highest). Port of Savannah is the largest and fastest growing container port in America.

- Airfreight is experiencing delays due to lack of labor and equipment which is impacting spares. Customers need to understand they need to send spares well before the berthing schedule.

Montreal

- The rainy summer season in the Quebec province has led to increasing fruits and vegetables prices. The persistent and sometimes intense rainfall so far this summer has damaged fields to the point where they are inaccessible and waterlogged.

- Another challenge we are facing continues to be the labor shortage.

Vancouver

- Terminals are working through the back log from July Strike.

- Rail car / product delays due to wildfires causing long wait at the ports.

- Coca Cola remains on strike, and their products are low stock in the market.

Portland

Seattle

Panama

- The Panama Canal: Ships are waiting as long as three weeks to cross the waterway due to a restricted number of crossings as a result of drought in Lake Gatun. Current restrictions limit 32 transits per day and draughts to 13.41 meters. Restrictions are expected to remain through the end of 2023 and into 2024. The 50-mile-long canal relies on rainwater to replenish itself, and each container ship requires about 50 million gallons of water for passage. Only some of that water is recycled.

- This may also result in a benefit – vessels carrying less cargo to lighten the weight and This will most likely cause ship owners to explore alternative routes.

UAE

- For the UAE, we are currently in the month of high temperatures, and with humidity it can feel like 50+ degrees.

- This has a major impact on our deliveries and barge supplies when it comes to fresh fruit and vegetables. We are always taking our precautions, but any delay during offloading or in the barge will result in a claim.

- Furthermore, we are in the middle of moving to our new warehouse! So very exciting for the WME branch.

Singapore

Dalian, Shanghai & Shenzhen

- Prices of seafood have slightly increased affected by Japan’s discharge of radioactive water into the sea.

- Due to recent typhoon weather, there is a certain impact on the vessels’ schedule and ship supply.

Rotterdam

- After two consecutive quarters of decline, The Netherlands now officially is in a recession. It is not expected to be a deep and long recession. To look at it from a ‘positive’ view, a mild recession could cool down the still overheated labor market a bit.

- The introduction of a new system, called DMS, by the Dutch Customs Organization has started. First part of the integration with Wrist Rotterdam went without any operational hick-ups. Next phase of implementation is expected in Q4 2023.

Algeciras

Aalborg

- We see a continued high road logistics cost in Europe due to new EU regulation and high fuel/ labor cost, not expected to decrease in the near future. However, FCL cost has normalized.

- Supply of most consumer goods has stabilized and is more or less back to normal. There are only a few items that are still causing supply chain issues.