Commodity prices relatively stable, but still remain elevated

Market and business update - June 2023

Read report as PDF here

Read report as PDF here

Oil prices, freight rates, and transit times continued dropping in April and May 2023 at a low pace, but remain considerably higher than average pre-inflationary levels. Food prices – though also still significantly higher – have dropped marginally since January 2023. Yet, especially rice and olive oils are highly influenced by lower supplies due to extreme weather in certain parts of the world.

This market and business update intends to give you an indication of the expected price development of the most important commodities, freight rates, supply chain challenges, the additional effects of labor shortages, and challenges in major ports.

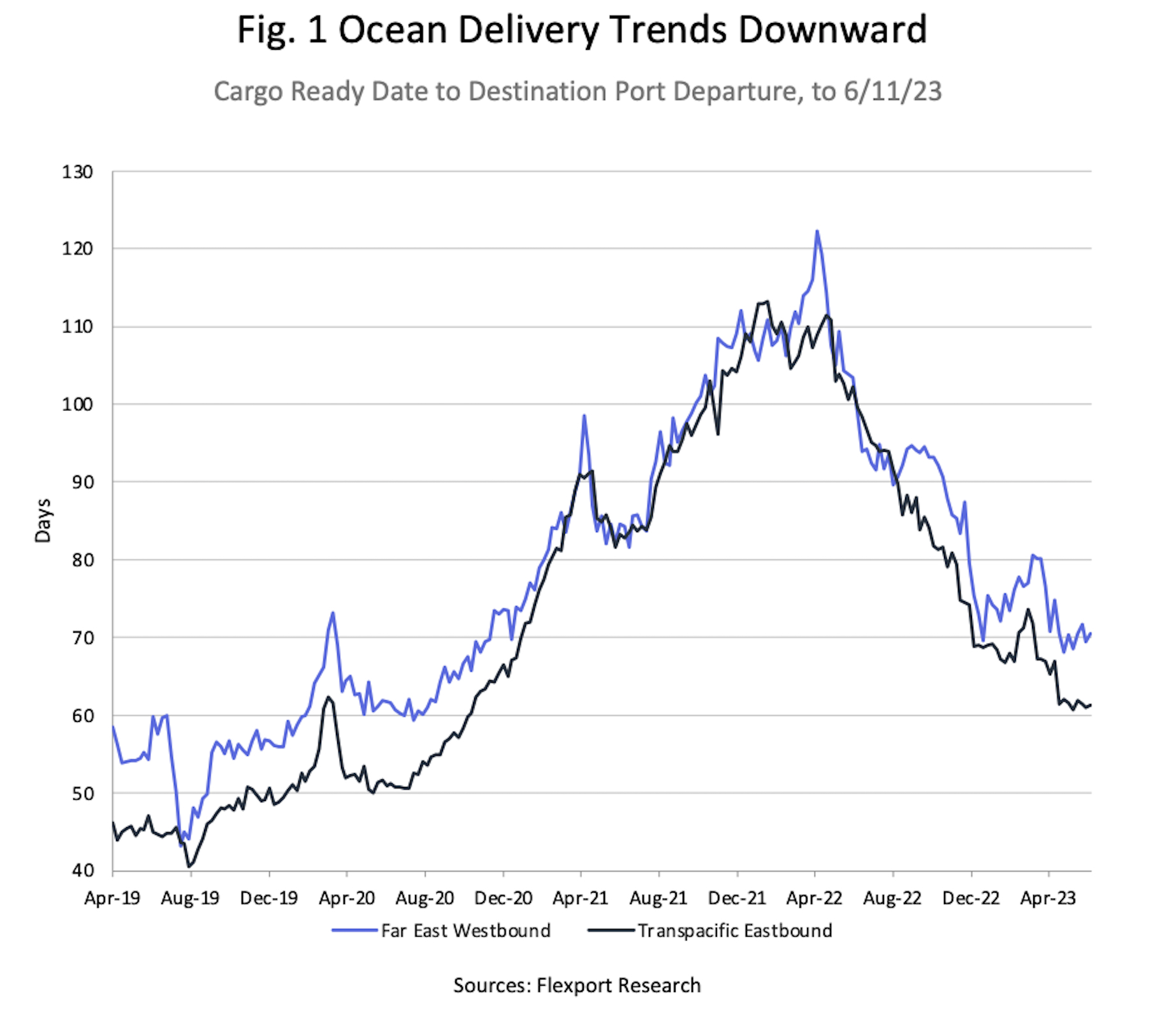

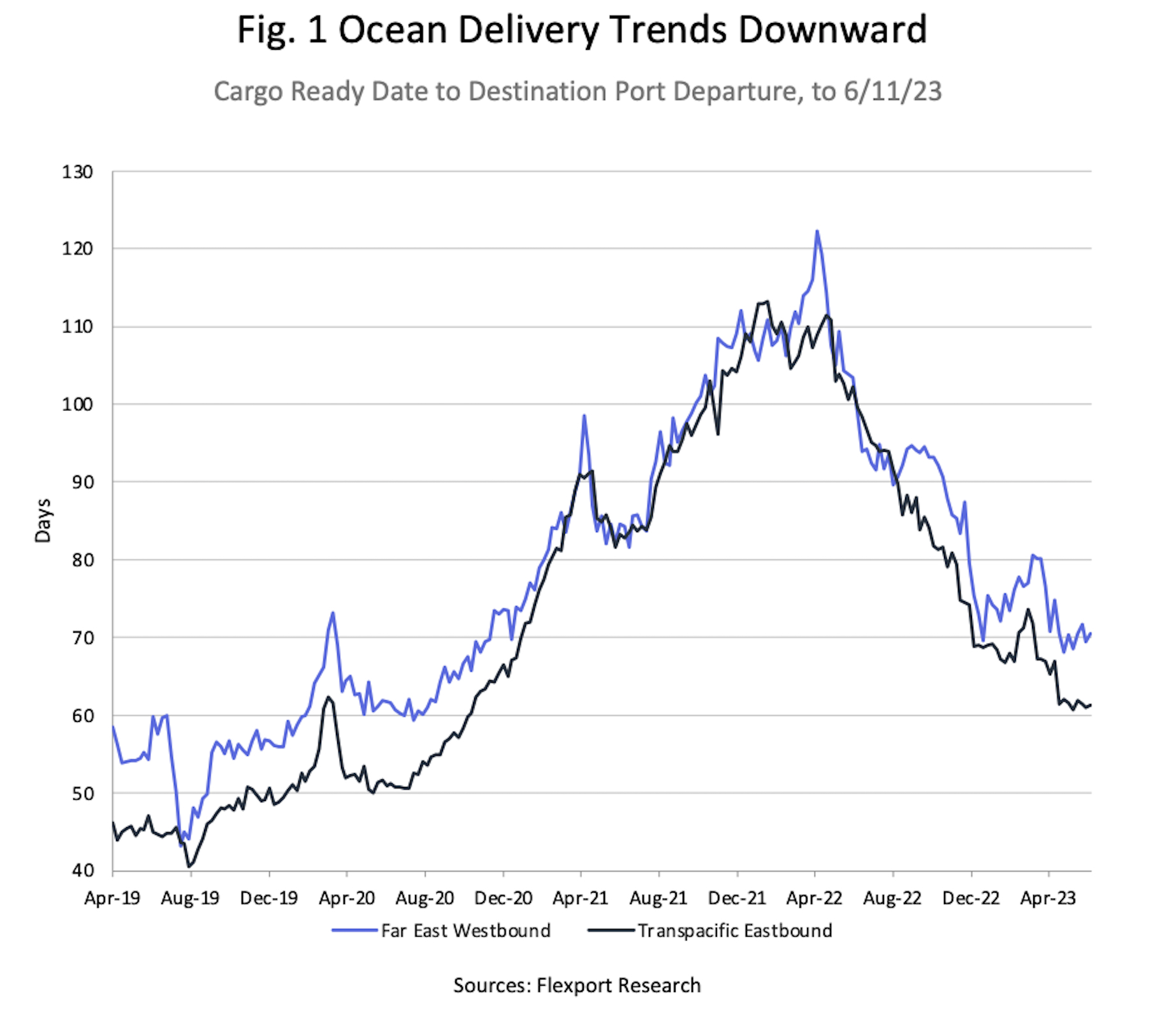

Transit times still decreasing, but remain above pre-pandemic level

According to the Flexport Ocean Timeliness Indicator, TPEB transit times have decreased slightly since March 2023, matching the fastest transit time since November 2020. FEWB decreased from 80 days in March to 69 days in June, in line with average level in November 2020. The transit times are still decreasing, however levels are still well above pre-pandemic level.

The Flexport Ocean Timeliness Indicator (OTI)

Transpacific Eastbound (TPEB)

- October 2021: 102 days

- October 2022: 82 days

- March 2023: 67 days

- June 2023: 61 days

Far East Westbound (FEWB)

- October 2021: 103 days

- October 2022: 89 days

- March 2023: 80 days

- June 2023: 69 days

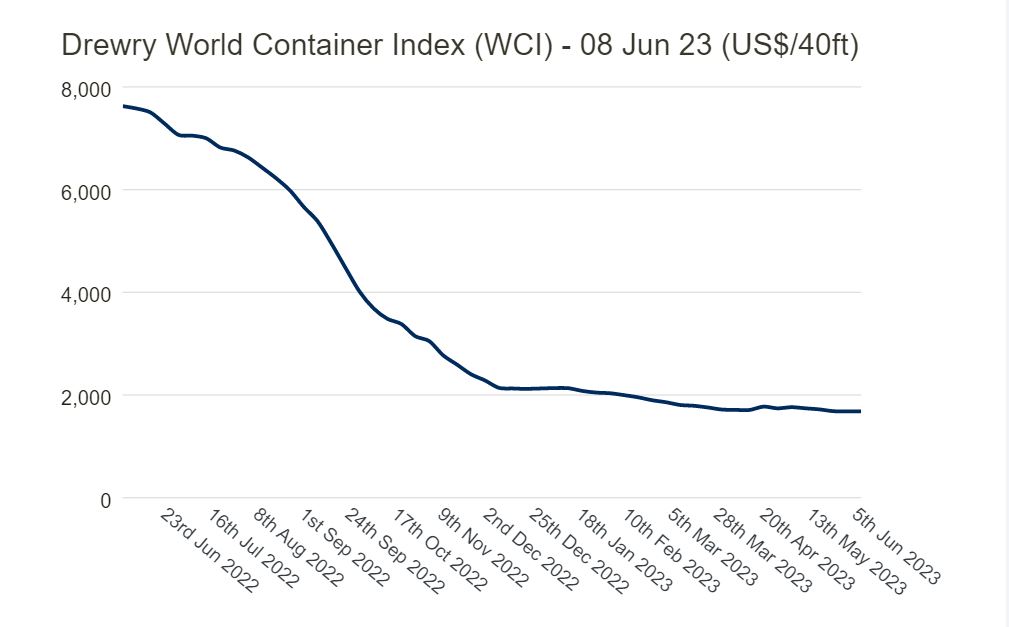

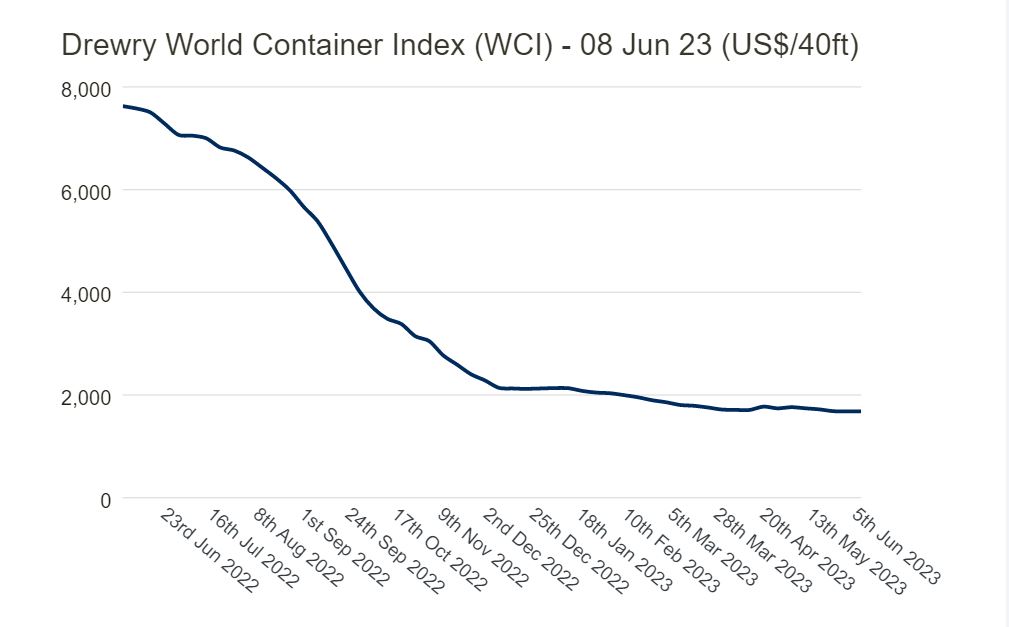

Freight rates remain stable, but still 18% higher than pre-pandemic levels

According to the Drewry World Container Index, a 40-feet container is now 84% below the peak reached in September 2021, indicating a return to more normal price levels. However, the container index still remains 18% higher than average pre-pandemic rates in 2019. Freightwaves also considers the market to have normalized, but predicts a moderate increase in the peak season ahead.

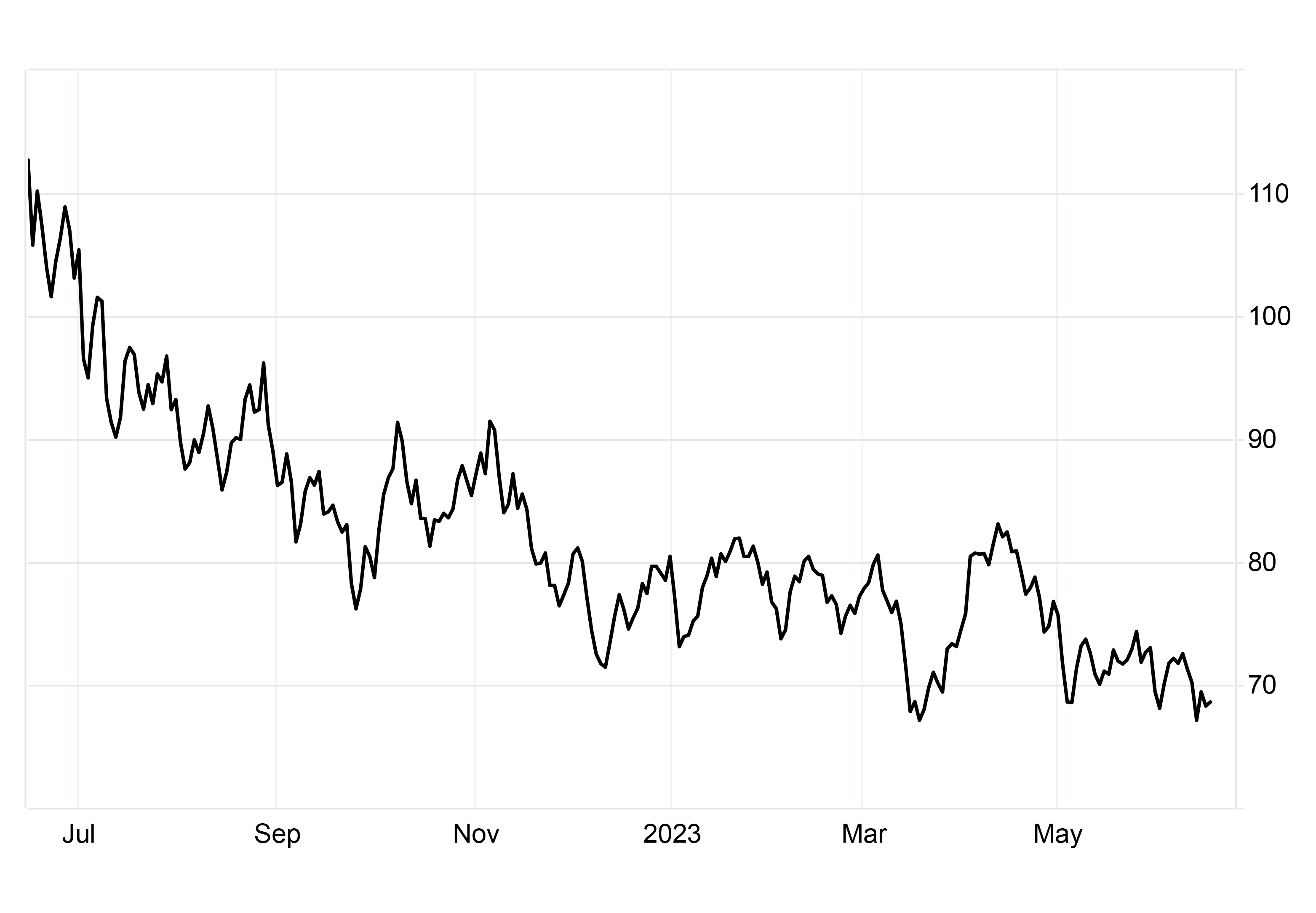

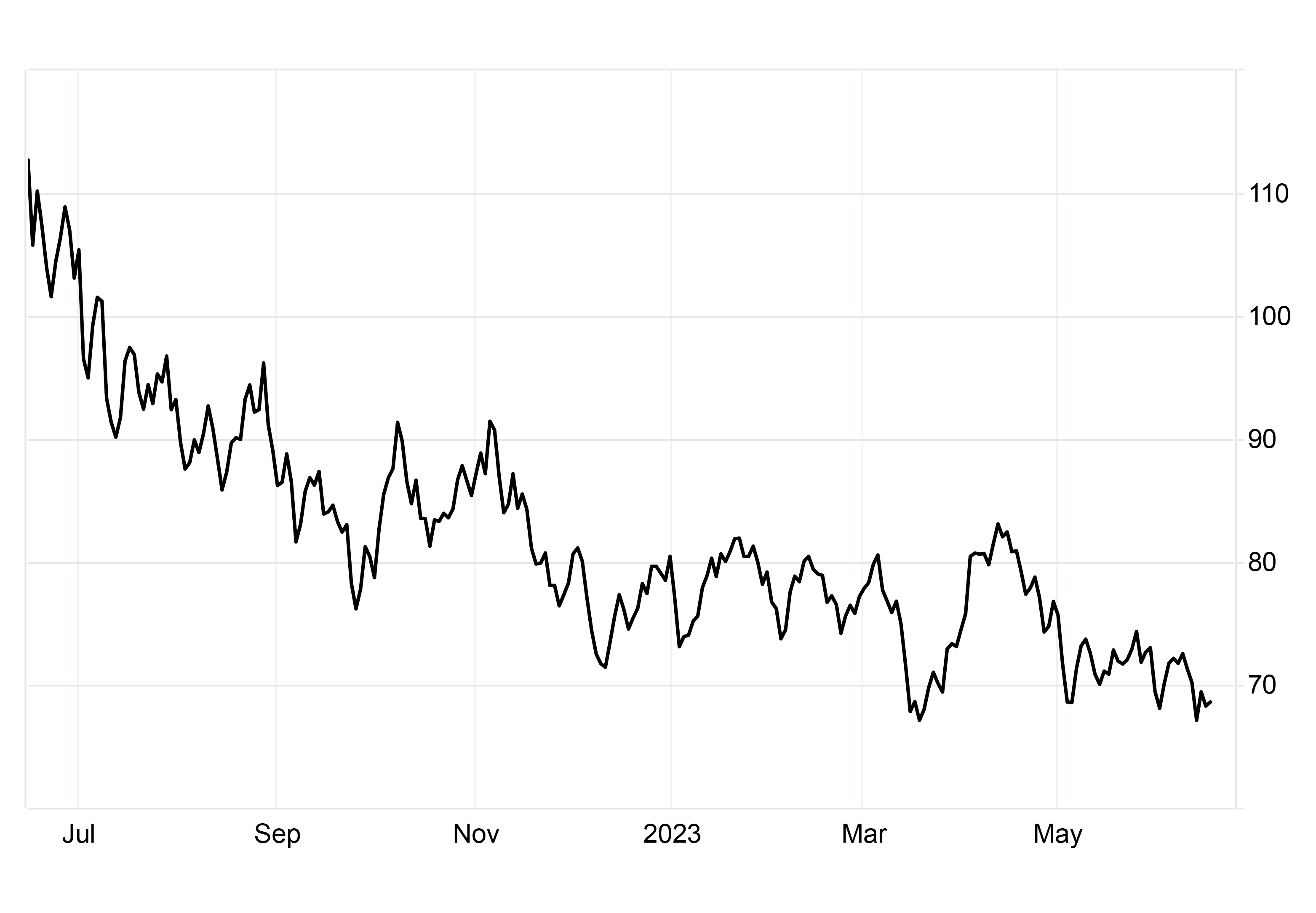

Oil prices still slightly dropping from last year, but are expected to increase in 12 months’ time

Oil prices reached USD 70 a barrel this week, dropping from USD 107 in June 2022. However, crude oil is expected to rise by 6% from 2023 to 2028 due to an expected robust demand from the petrochemical and aviation sectors after 2026, although the use of oil for transport fuels is set to decline due to the expansions of electric vehicles. (Source: Trading Economics Index)

Commodities relatively stable the recent months, but adverse weather patterns driving up rice and olive oil prices

According to the CRB Index, the overall commodity prices remained relatively stable since late April 2023 and landed around index 250 this week, however commodity prices still remain on an elevated level compared to pre-pandemic prices at index 125. Due to the intermediate downturn of the commodity index, some provisions and stores have decreased slightly whereas others have stabilized or increased. Other factors, including shortages in agricultural supplies related to the Russia-Ukraine war and adverse weather patterns, will maintain the high commodity price level in 2023

According to the FAO Rice Price Index, rice averaged 127.8 points in May 2023, up 2.9% from April and its highest level since October 2011. The recent drought in China has caused lower crops, and the flooding in Pakistan and India brings destruction to rice crops. Concerns over the potential production impacts of the emergence of an El Niño also spread further price increases in the Pakistan rice market. Rice prices rose the most in Vietnam and Pakistan – in Pakistan prices are 16% above last year’s price level.

In Spain, olive oil prices have hit record levels, thanks to a prolonged drought. Spanish olive oil prices have been pushed to the highest level in 26 years (Source: IMF Global Crop Prices).

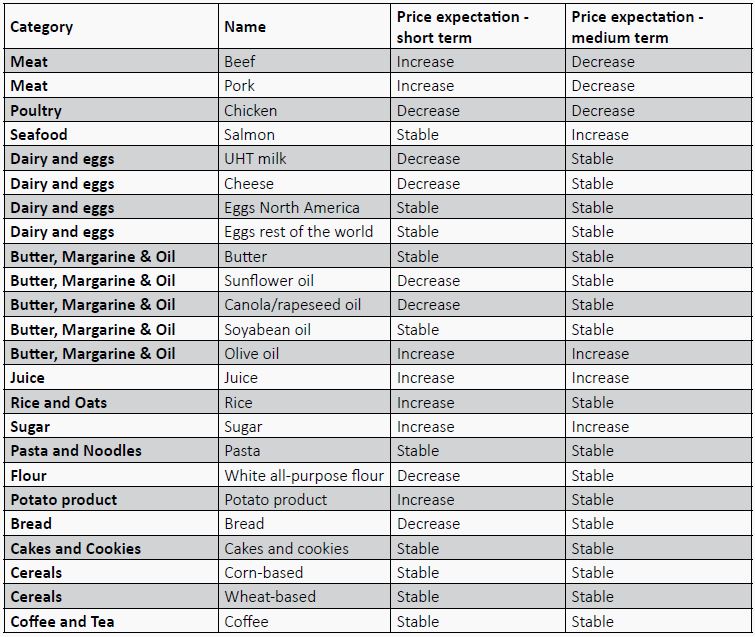

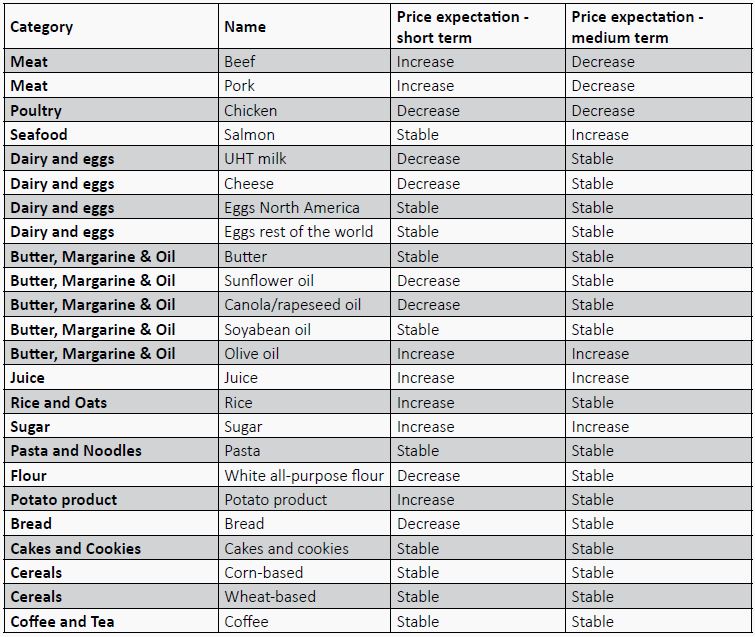

Inflationary impact on provisions on short and medium term

On short term, we do not foresee any major shortages on provisions as our existing contracts are still honored by our suppliers, giving high priority to large customers. However, this situation might change any time due to volatility, forcing us to substitute certain products with comparable products.

According to the FAO Food Price Index, food prices averaged 124.3 points in May 2023 and dropped marginally compared to January 2023, continuing the downward trend since its peak of 160 points in March 2022. Still, the FAO Food Price Index is significantly higher than pre-pandemic food price levels.

Inflationary impact on provisions on short and medium term

Due to the inflationary effects, we expect certain price increases within the provision categories on short and medium term. The list is not exhaustive.

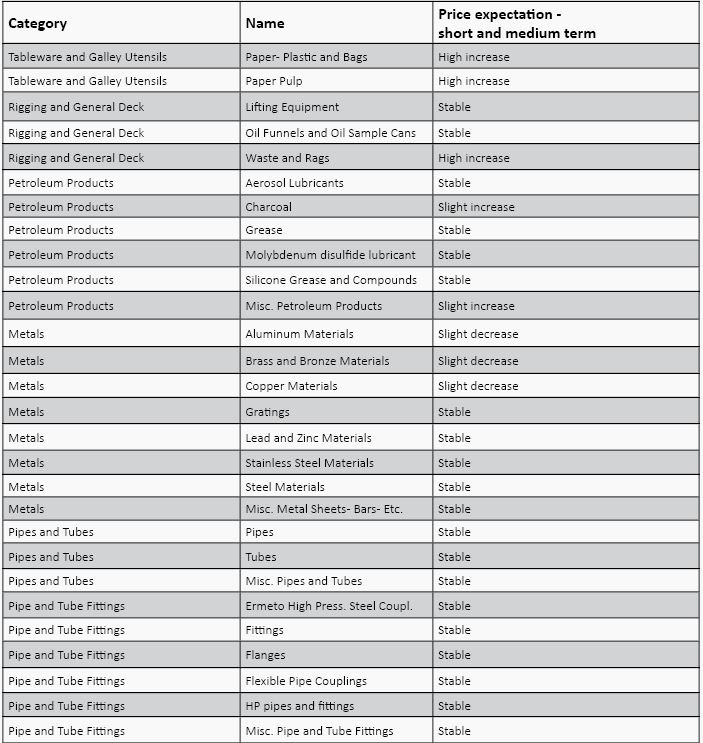

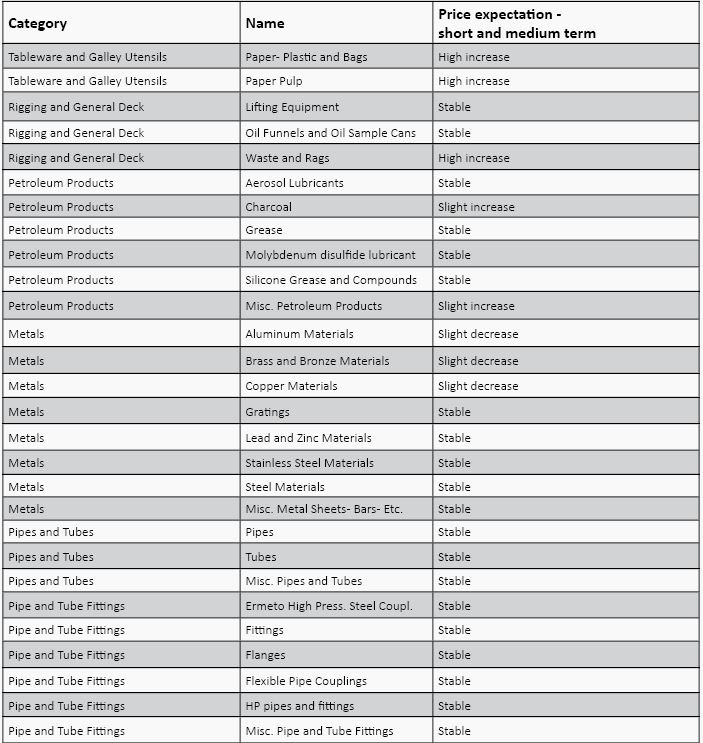

Inflationary impact on stores on short and medium term

On short and medium term, we do not foresee any shortages on technical consumables and stores. However, this situation might change any time due to volatility.

The raw material of several commodities has been decreasing during recent months, for which reason we expect the prices of the following stores categories to decrease or stabilize on short and medium term. The list is not exhaustive.

Inflationary and other macro impacts on major ports

| HOUSTON |

-

We are still seeing increased holds and document reviews from Customs, FDA, and USDA on inbound cargo. Stations for intensive inspections are backed up with containers in line to be inspected and it takes up to 6 weeks until we see the container released back to us. Importer is responsible for all the fees. Some of the containers are getting reloaded to another vessel during voyage and we see delays up to another month until container reaches the destination. These compounded issues have led to unexpected and fluid increases in lead time, forcing us to bridge buy items at higher prices and/or short orders.

-

Still dealing with requirements on hazardous items. There are a lot more items added to the list from our sourcing offices in China and Rotterdam that no longer are allowed to be consolidated on the same container. Extensive list of items, such as refrigerators, fuses, markers and magnets cannot be shipped on the container at all and have to be sourced locally at a higher price. Wholesalers are not given much distinction nor priority, often times leading to either no available product or being short product that was ordered. Again, these issues are causing us to bridge buy items at higher prices from retailers and/or short customers’ orders. There is a select group of products, including Atta flour and sawdust, that are currently not available on the market due to production, export restrictions, and raw material disruptions.

Packing material costs have stabilized. Additionally, the cost and availability of pallets have stabilized; even seeing a slight decrease in cost. All of these costs are still dramatically higher than pre-COVID-19, but we feel that we are past the peak from a cost and availability perspective. The Houston branch recently transitioned into a much larger, state-of-the-art facility and started operating out of the new facility on March 27th. This larger location will allow for more items to be stocked and shorter lead time on stock to all locations throughout WNA as Houston is now both a Distribution Center and an Order Fulfillment Center.

-

In Corpus Christi, TX; Phase Four of the Port Expansion Project has come to a halt due to the inclement weather and is projected to start work again in the middle of April. Once complete, large vessels will be allowed into the port. In the interim, it will cause delays (particularly in Ingleside) but has huge benefits once completed. There is more information on the project available at https://harborbridgeproject.com/.

|

| NEW ORLEANS |

- NOLA is seeing multiple grain terminals close in the coming 8 weeks. Both Zen-noh grain terminal and CHS harvest states terminals were closed during May. They have reopened in June, but traffic is very slow if not nil

- ADM reserve terminal is closed until 8/16

- ADM is expected to be closed from mid-June until 9/05

- ADM Destrehan is expected to be closed from mid-June until 9/15

- Cargill reservice upper berth is closed from 7/10 until 7/24

- Cargill Westwego is closed from 8/24 until 9/7

|

| LONG BEACH |

|

| NEW YORK/ NEW JERSEY |

-

East Coast port volume went up 3%. This shift wasn’t all caused by the pandemic. Labor disputes on the West Coast have frightened shippers and retailers, who worried that a strike might break supply chains all over again. But this shift away from the West Coast was actually happening even before all that.

-

For East, expect volumes to remain at higher levels than pre-pandemic primarily, as these ports have proven to be viable options for shippers. However, as overall demand continues to drop, total volume will also continue to fall.

-

Most East Coast ports are focusing on equipment updates, software enhance-ments, and improvements to accommodate the massive new containerships on order. A record 2.5 million TEUs of new containerships are scheduled for delivery this year.

|

| JACKSONVILLE |

-

We are experiencing an exponential increase in our operating cost due to the fuel, insurance, and maintenance fees going up.

-

The cost for new assets continues to increase and the availability remains bleak.

-

The labor market continues to be the most challenging that we have seen. We continue to face driver shortages and we have been forced to increase wages. We continue to face warehouse associate shortage, and we have been forced to increase wages to retain the people we have. We still struggle to find people that want to work, and the hiring is still very difficult.

-

Port congestion in the South East continues in certain ports (Savannah and Charleston the highest). Port of Savannah is the largest and fastest growing container port in America.

-

Cost of drivers having to stay overnight continues to see high rates at hotels.

-

Airfreight is experiencing delays due to lack of labor and equipment which is impacting spares. Customers need to understand they need to send spares well before the berthing schedule. It can land here on Monday but with the shortage of staff at the airports, they may not clear the package until Friday of that week. They are in no hurry and will let you know that as well.

|

| MONTREAL |

- Wildfires across Canada have led to some delays with heavy smoke reaching all the way down parts of the East Coast of the U.S.

|

| VANCOUVER |

- Due to wild fires across the country, there has been a slowdown in rail traffic.

- The restriction of chicken and egg importing from the US due to the avian flu has caused the prices to remain high.

|

| PORTLAND |

- Portland is seeing the same labor issues as Seattle but no strike in the port as of yet.

|

| SEATTLE |

- Seattle having some issues with striking longshore due to the ILWU contract disputes. It has not affected our deliveries so far, but something to keep in mind. This potentially could disrupt all west coast ports.

|

| PANAMA |

|

| UAE |

- Crude oil prices continue to be low.

- Many Middle Eastern countries tie their currency exchange rate to the USD, and oil revenues play a significant role in potential devaluation resulting in a higher inflation rate, which is already highly due to the global market situation.

|

| SINGAPORE |

|

| DALIAN, SHANGHAI & SHENZHEN |

-

Affected by the exchange rate of US dollar, the prices of imported products have slightly increased.

-

With the arrival of summer and the ensuing typhoon weather, there will be a certain impact on the vessels’ schedule and ship supply.

|

| ROTTERDAM |

- The Dutch labor market remains very tight, causing increased costs. It really is our main challenge. It is expected to continue for at least another 12 months. Since Q4 in 2021, there have been far more vacancies than unemployed people.

- The Dutch customs is preparing the launch of a new system. This will have some operational impact we are preparing for.

|

| ALGECIRAS |

|

| AALBORG |

-

FCL cost level on pre-covid state, enabling lower logistics cost on overseas imports.

-

Road logistics cost still high in Europe due to new EU regulations and high fuel/labor cost, not expected to decrease in the near future.

-

Inflation is slightly decreasing in Denmark, but price level remains high on most product groups.

-

Supply of most consumer goods are stabilized and more or less back to normal, but the draught in Europe expected to influence price and supply of fresh prod-ucts.

|