Date: 04 July 2022

Market and business update - July 2022

The shipping and ship supply industries have suffered from port congestions, freight rates, and crude oil prices at an unprecedented level for many months now. Transit times and price level still remain far above pre-pandemic levels, radically impacting the commodity prices and general market conditions. However, for the first time, we see minor inclines in transit times, freight rates, and crude oil prices.

This market and business update intends to give you an overview of expected fluctuations within the most important commodities, freight rates, supply chain challenges, and the additional effects of labor shortages, increased lead times and delays in major ports. Finally, we sum up what Wrist Global Procurement continuously does to mitigate and reduce the inflationary impact.

Port congestion may be slowing down

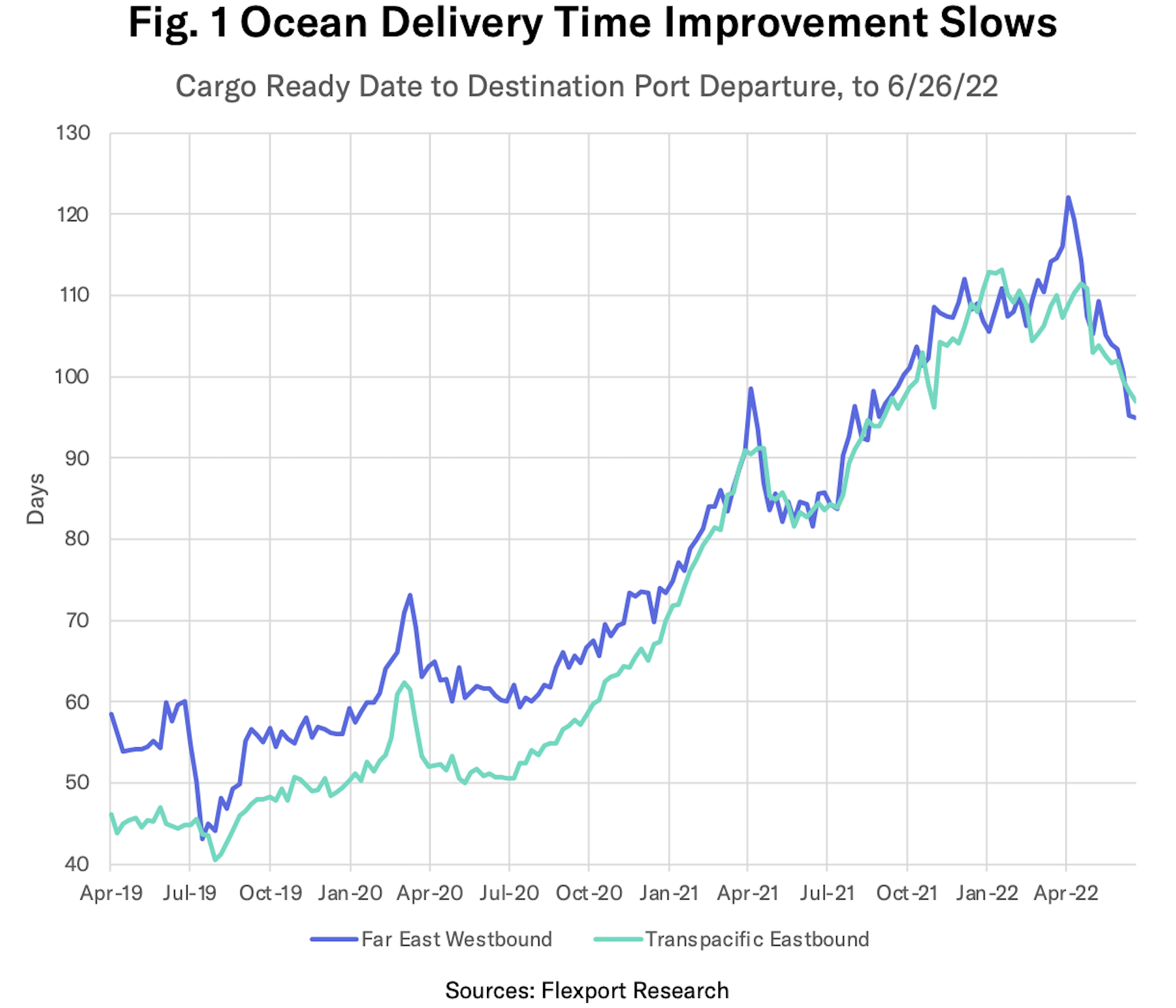

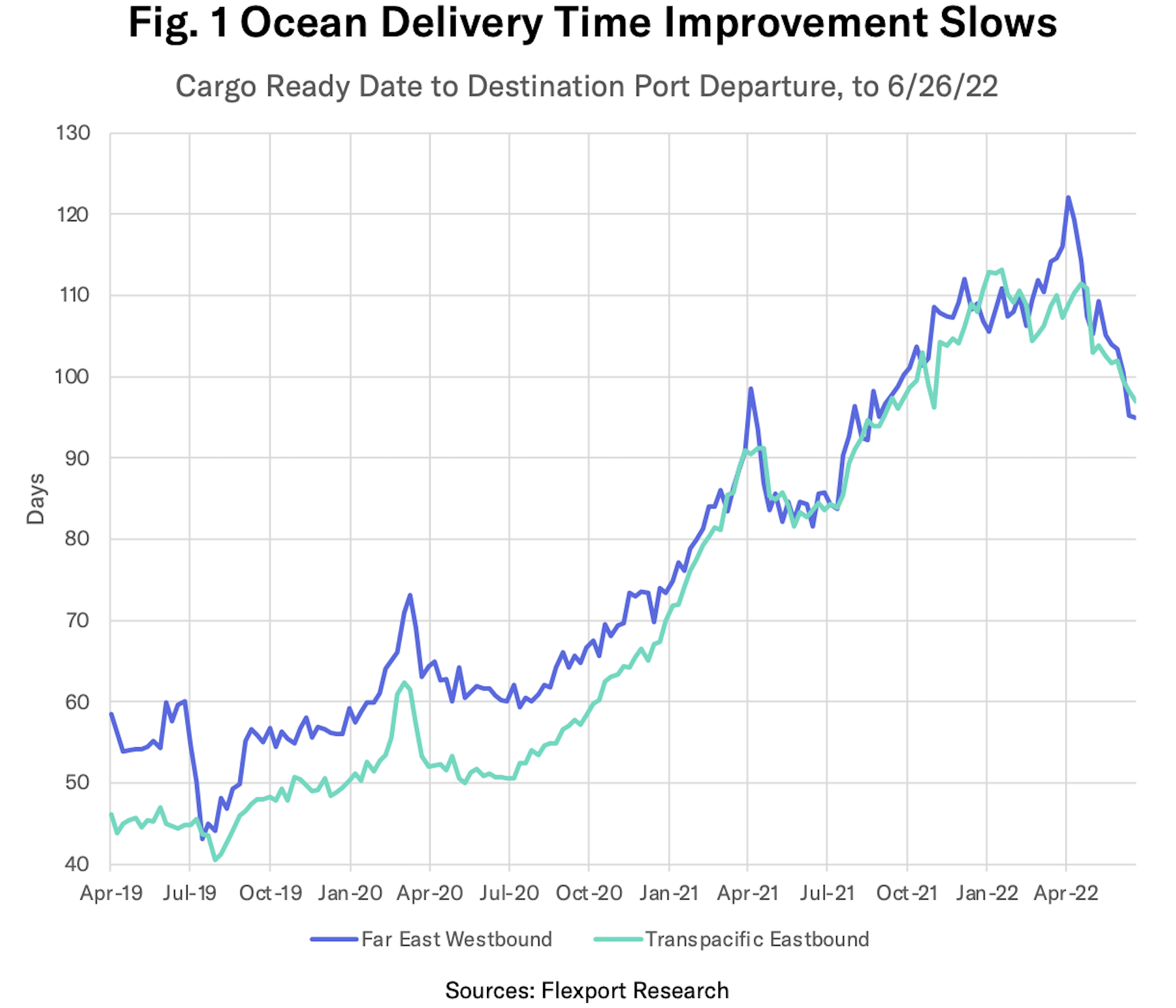

Having suffered from considerable wait times, congestion, and delays for months across all main ports, the Flexport Ocean Timeless Indicator may be showing that the worst of late 2021 congestion has passed. Transit times still remain above pre-pandemic levels, but according to Flexport Research, the ocean timeliness for both eastbound and westbound trade lanes (FEWB and TPEB) saw reduced transit times. TPEB fell to 97 days, returning to the level in November 2021, and FEWB dropped to 95 days, staying at September 2021 levels.

The Flexport Ocean Timeliness Indicator (OTI)

The Flexport Ocean Timeliness Indicator (OTI)

Transpacific Eastbound (TPEB)

- March 2021: 90 days

- March 2022: 108 days

- May 2022: 103 days

- July 2022: 97 days

Far East Westbound (FEWB)

- March 2021: 98 days

- March 2022: 110 days

- May 2022: 105 days

- July 2022: 95 days

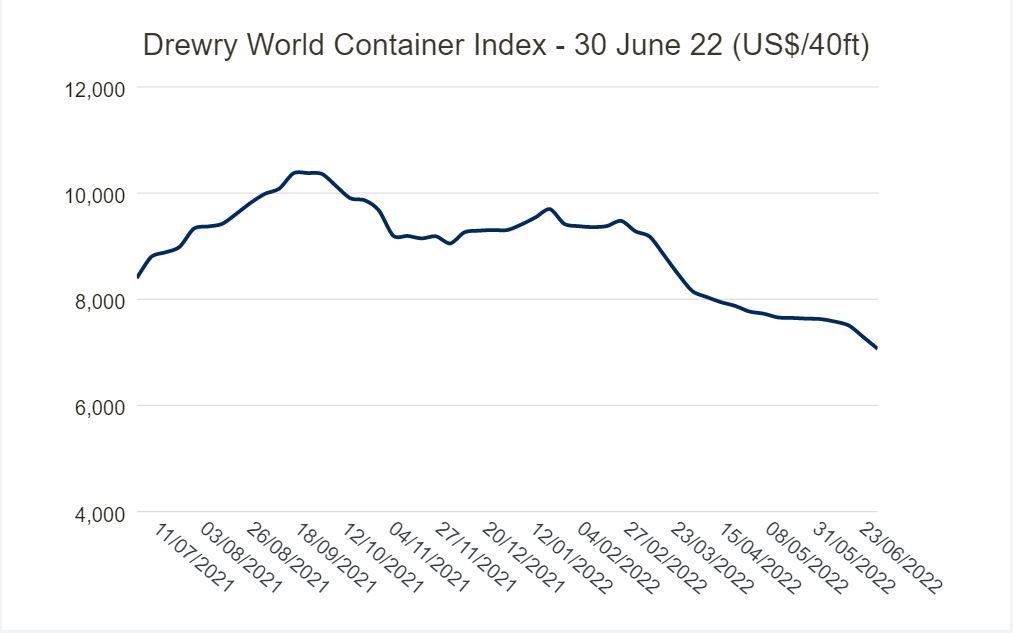

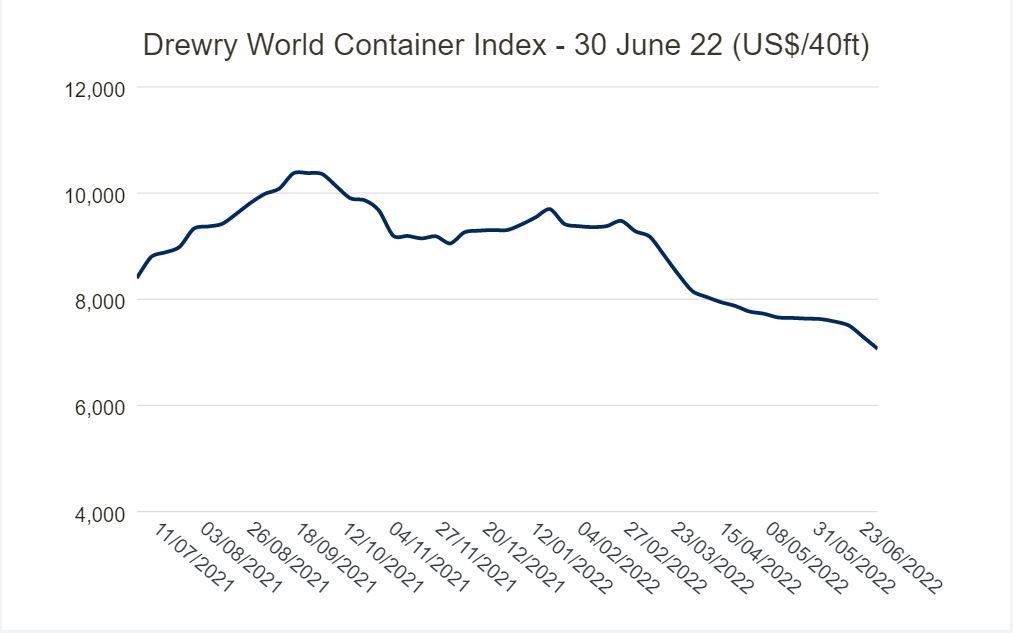

High freight rates decreased by 2.5% since mid-May

High freight rates decreased by 2.5% since mid-May

Freight rates are likely to remain elevated through 2022 due to increased fuel prices and congestion in supply chain. However, according to the Drewry World Container Index, the container price decreased by 2.5% since May per 40ft container.

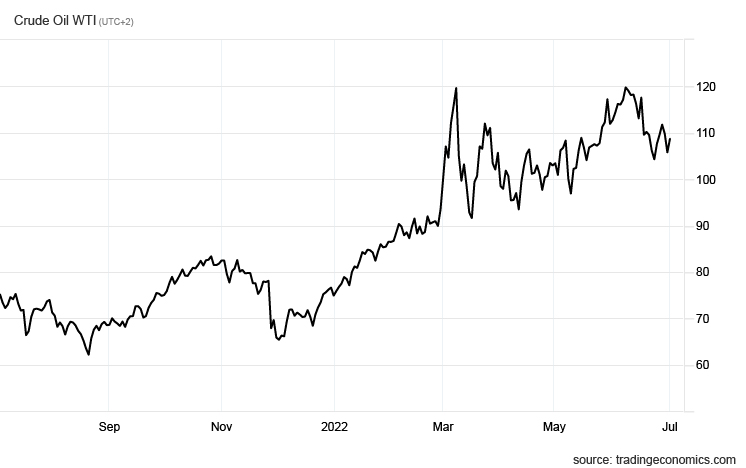

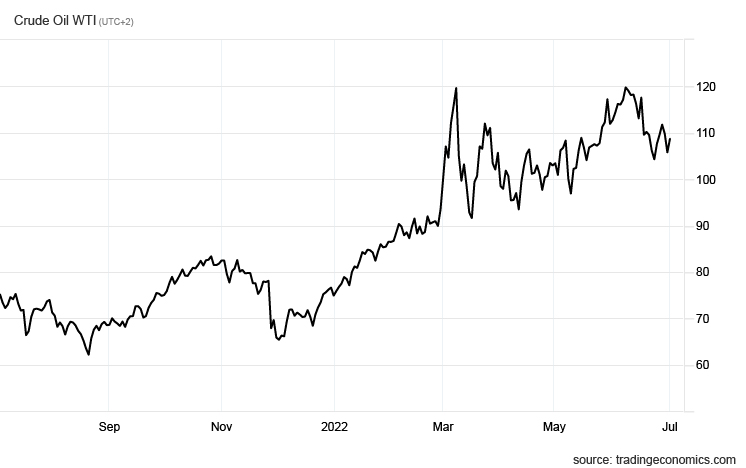

High crude oil prices saw the first slight decline since November 2021

The high crude oil prices driven by the discontinued Russian oil supplies, due to the war in Ukraine, saw the first slight incline in June since November 2021. This slight incline is mainly driven by expectations of an economic slowdown, a minor decrease in demand for oil, and an expanded oil production in several OPEC-countries, including Saudi Arabia. Still, the US oil benchmark is up about 45% this year.

Source: Trading Economics Index

Inflationary impact on commodity prices

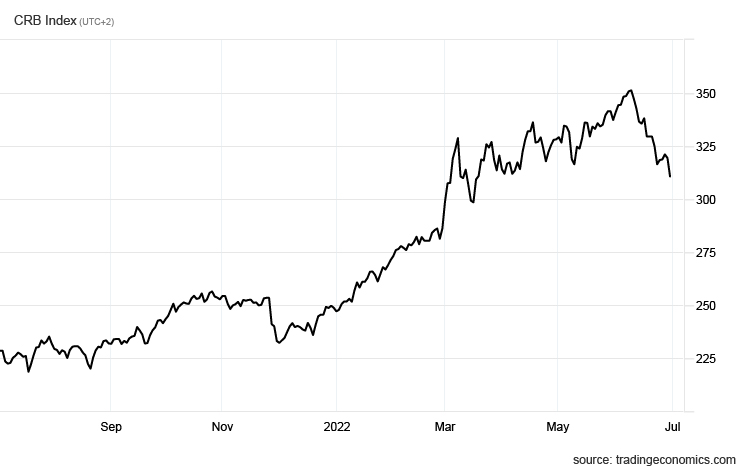

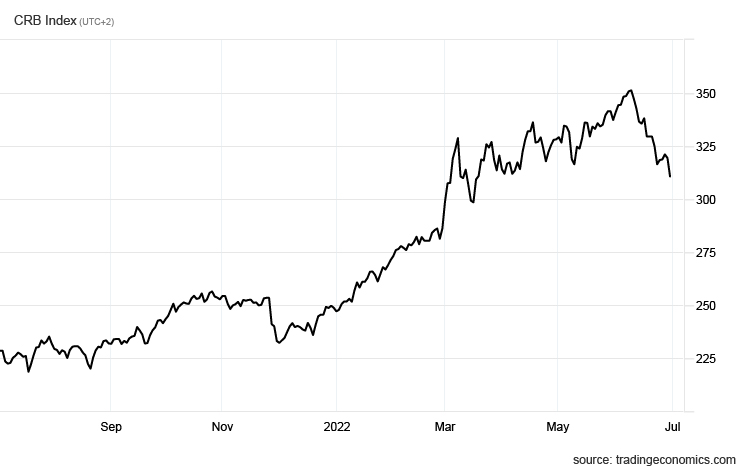

According to the CRB Index, the commodity prices increased 64.29 points or 26.03% since the beginning of 2022. At the beginning of Q1, the CRB commodity index stood at 298.85 index points. On the ninth of May, the index was at 318.85 index points, and on June 24th, it stood at 321.54, elevating also the price level of certain provisions and stores.

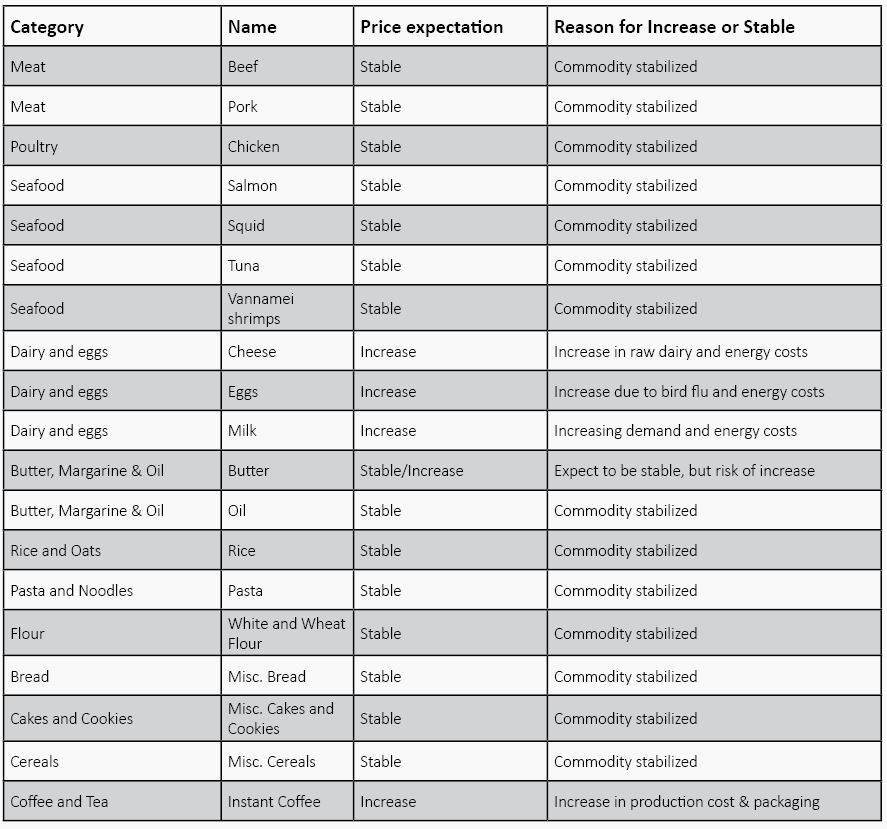

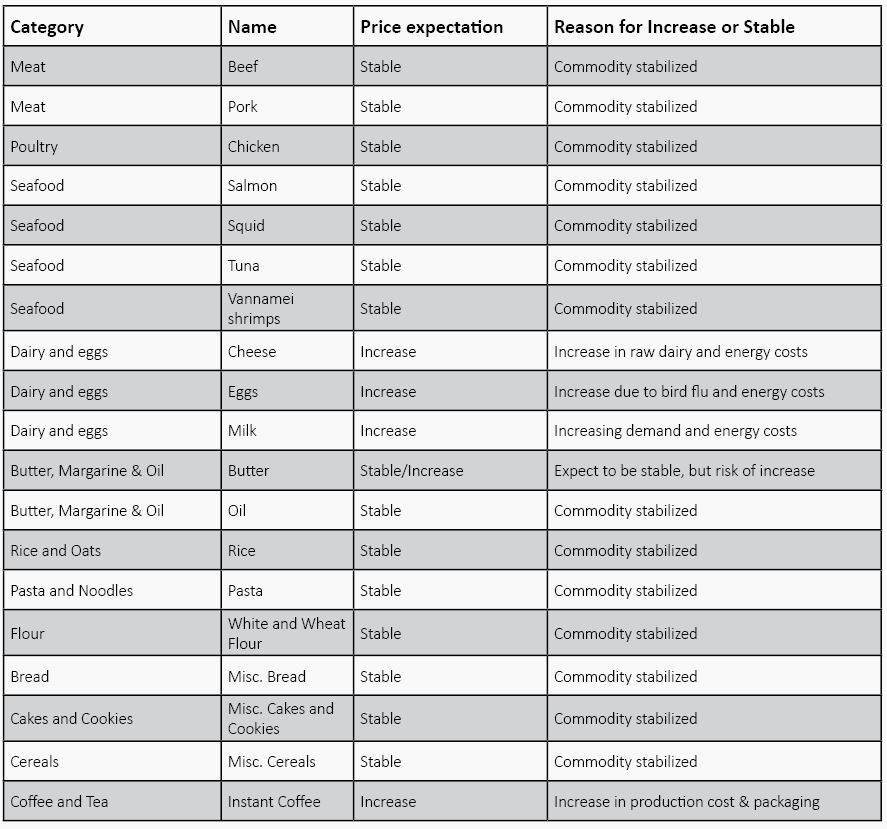

Inflationary impact on provisions

On short term, we do not foresee any major shortages on provisions as our existing contracts are still honored by our suppliers, giving high priority to large customers. However, this situation might change any time due to volatility, forcing us to substitute certain products with comparable products.

According to the FAO Food Price Index, food prices averaged 157.4 points in May 2022, down 0.9 points or 0.6% from April 2022. Still, the food prices are 29.2 points or 22.8% above its value compared to May 2021.

Due to the inflationary effects, we expect certain price increases within the provision categories on short term. The list is not exhaustive.

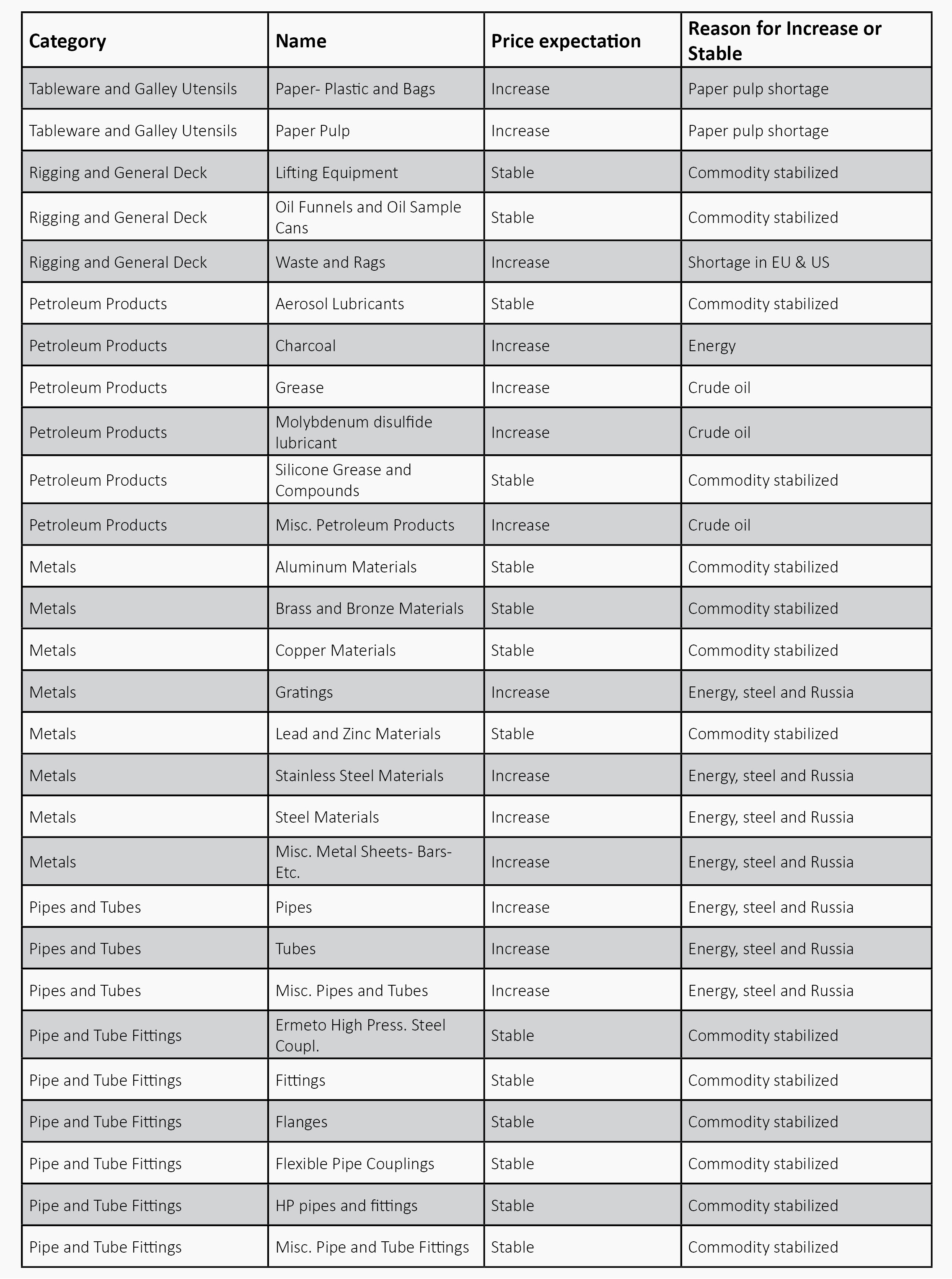

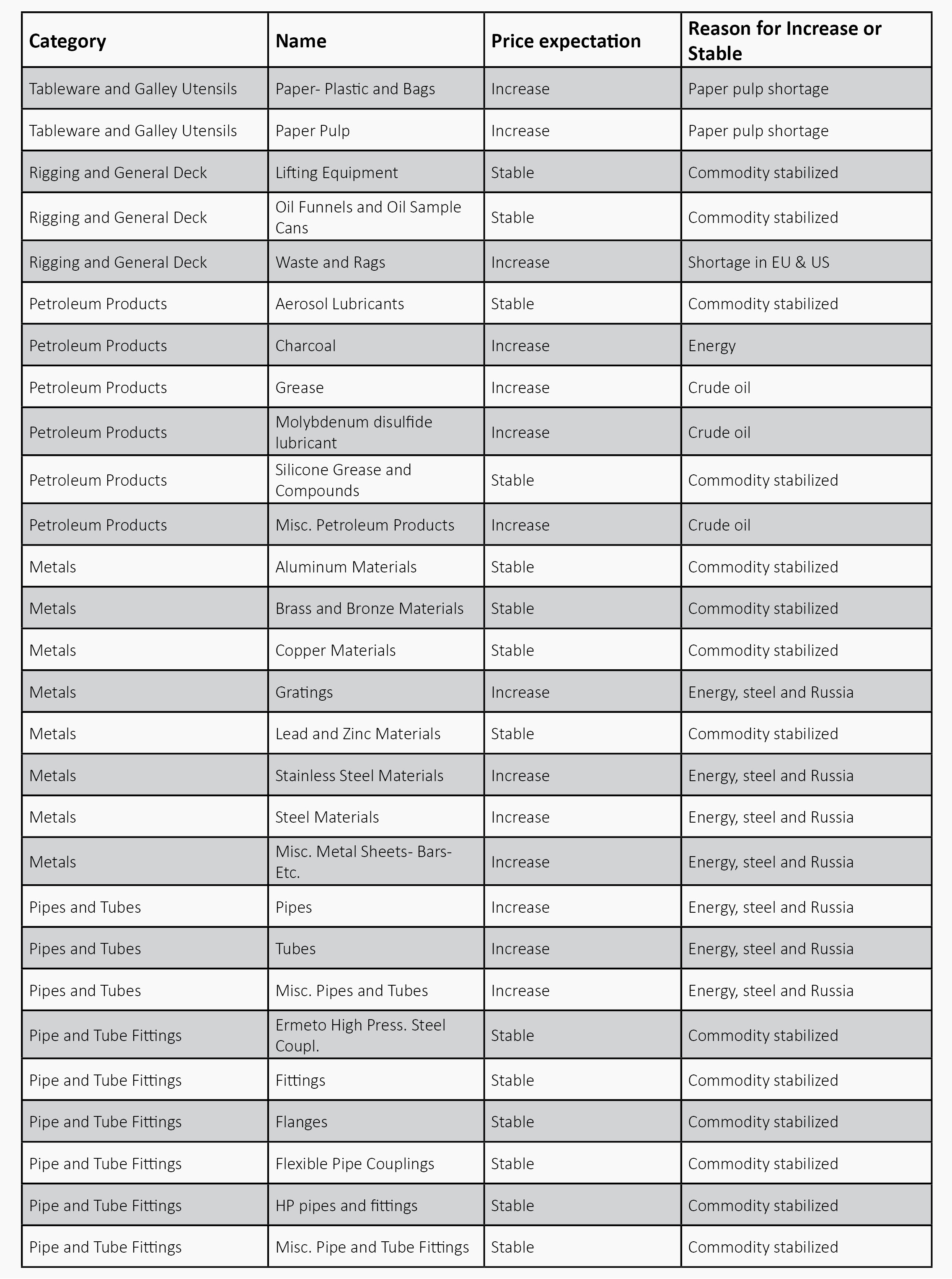

Inflationary impact on stores

On short term, we do not foresee any shortages on technical consumables and stores. However, this situation might change any time due to volatility. The significant rise in oil and gas prices in 2022 is feeding through into higher inflation, effecting raw materials, transport costs, energy costs and production costs. Due to the inflationary effects, we expect the prices of the following stores categories to increase on short term. The list is not exhaustive.

Inflationary and other macro impacts on major ports

North America

overall |

- We have seen an extremely high level of inflation in the United States over the past year. January through April of 2022 compared to the same period in 2021, the cost of goods sold on beef, pork, chicken, milk and eggs have increased $1.9 million versus about $200 – 250,000 in Europe, the Middle East and the Far East.

- We are experiencing an exponential increase in our operating cost due to the fuel, insurance and maintenance staying at a very high level.

- The cost for new assets continues to increase, and the availability remains bleak.

- The labor market is challenging. We continue to face driver and warehouse associate shortages and increased wages to retain the great talent we have.

- Airfreight is experiencing severe delays due to lack of labor and equipment which

is impacting spares.

|

New York/East

Coast |

- East Coast ports are seeing an increase in traffic of up to 30%. East Coast is in danger of trucking delays with a lack of available truckers.

|

Long Beach /

West Coast |

- Peak in container volumes seems to be growing, but the port of Long Beach keeps trying to maintain the backlog – May was the 3rd best month ever.

|

| Southeast |

- Port congestion in the Southeast continues in certain ports, especially in Savannah, Charleston, and Jacksonville.

|

| US Gulf |

- High container volumes causing delays, both locally but also from shipping liners. Chassis shortages continue and drive additional lead time and higher product cost.

- We are seeing large supply issues from our vendors, and all steel suppliers due to the recent Chinese lockdown as well as labor and material shortages.

- Shortages remain the biggest issue. Pallet shortages are driving up logistical cost.

- Currently seeing big delays with incoming airfreight – affecting both ship spares and incoming stock.

- Terminal fees are increasing and being implemented in terminals around New Orleans.

- With the current rise in fuel and labor cost, we are seeing an increased cost on the barges.

- 3rd party courier charges are currently being affected by driver shortages and labor cost.

|

| Montreal |

- Lack of manpower remains the biggest issue, and now, we are currently seeing increased delivery time from main vendors.

|

| Vancouver |

- We are no longer able to import eggs from USA due to Avian Flu.

- Seeing a small delay in the container ETA domestic due to recent train derailment.

|

| Rotterdam |

- Continuously massive shortage of labor in The Netherlands. This leads to longer lead times and increasing labor costs.

|

| Algeciras |

- Transport strike has been called off at the eleventh hour. We do not expect any delays in the Spanish ports in the near future.

|

| Singapore |

- The Monsoon season is about to start in Malaysia which impacts the price and quality of most of the green leafy vegetables such as lettuce, spinach, capsicum etc.

- Singapore Government is reducing the amount of permits for foreign workers, resulting in a shortage of manpower for all industries.

|

| Dubai |

- The fruit and vegetable category has entered the expensive summer season where local production is very limited. The market mostly relies on import which complicates the freshness of some fresh product categories.

|

| Shanghai |

- Supply at all ports and terminals in Shanghai gradually turned to normal from 1 June.

- Due to more than 2 months lockdown in Shanghai, on a short term, we experience a small shortage on imported provision items. Expected to return to normal by the end of June.

- Construction in Shipyards around Yangtze region is impacted by the lockdown causing an expected delivery delay of about two months.

|

| Aalborg |

- Price level for certain provisions is still getting higher and is very volatile.

- Shortage of commodities in specific categories now effects other commodities as demands move from one commodity to another.

- Especially non-food suppliers suffer from high freight rates and delays in supplies, putting pressure on reaction time from RFQ to Order.

|

The Flexport Ocean Timeliness Indicator (OTI)

The Flexport Ocean Timeliness Indicator (OTI) High freight rates decreased by 2.5% since mid-May

High freight rates decreased by 2.5% since mid-May

![]()